Top Ten Smart Money Moves – January 17, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on January 17, 2017 Data)

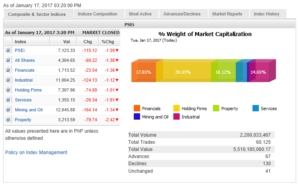

Total Traded Value – PhP 5.510 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 130 Declines vs. 67 Advances = 1.94:1 Neutral with Bearish Bias

Total Foreign Buying – PhP 2.249 Billion

Total Foreign Selling – (PhP 2.561 Billion)

Net Foreign Buying (Selling) – (PhP 0.312) Billion – 3rd day of Net Foreign Selling after continuous Net Foreign Buying for ten trading days

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

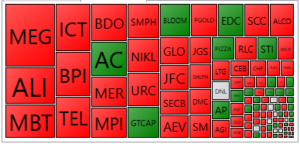

PSE HEAT MAP

Screenshot courtesy of PSEGET

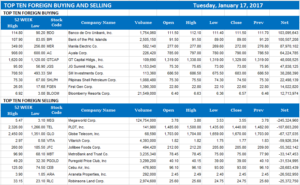

Top Ten Foreign Buying and Selling

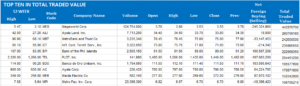

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Brexit,’ Trump uncertainty spook local stocks

Posted on January 18, 2017

LOCAL STOCKS dropped for a fifth consecutive session, as investors continued to await clarity on the planned exit of the United Kingdom from the European Union (EU) as well as US president-elect Donald J. Trump’s economic policy direction.

The benchmark Philippine Stock Exchange index (PSEi) on Tuesday plunged by another 115.12 points or 1.59% to settle at its intraday low of 7,123.33. The broader all shares likewise tumbled 60.22 points or 1.38% to 4,304.65.

“There was risk-off sentiment ahead of [UK Prime Minister] Theresa May’s speech and Trump’s inauguration,” Victor F. Felix, equity analyst at AB Capital Securities, Inc., said in a telephone interview.

Ms. May was scheduled on late Tuesday (1145 GMT) to deliver a speech outlining plans to proceed with Britain’s withdrawal from the EU single market, following the outcome of a referendum dubbed as the “Brexit” vote in June 2016.

“‘Brexit’ hasn’t happened yet. This will happen when the UK triggers Article 50, which will unlikely take place until around March. In the bigger picture, this presents a political risk in the euro zone area,” Mr. Felix said.

Mr. Trump, meanwhile, will take over the White House on Jan. 20. Markets are keeping a close watch on the leadership change for possible clues on the direction of the world’s largest economy.

“If there is increased spending in the US, most investors might decide to keep their money there to ride the boom cycle and there might be more outflows from the Philippines,” Mr. Felix noted.

“But again, we always fall back on fundamentals. We are one of the fastest growing economies in Asia, if not the fastest,” the analyst added, while acknowledging that Mr. Trump’s protectionist stance poses a risk to the Philippines.

Frank Gerard A. Barboza, equity trader at AP Securities, Inc., similarly attributed the selldown to concerns over the possible impact of Britain’s departure from the EU along with uncertainties over the leadership change in the US.

“Also, some liquidation for the coming BDO Unibank, Inc.’s stock rights offering could have added some selling pressure,” Mr. Barboza noted.

Accordingly, value turnover at the exchange stayed below average at P5.51 billion after 2.20 billion shares changed hands. Foreign investors further trimmed their holdings, posting nearly P311.99 million in net sales. Decliners trumped advancers, 130 to 67, while 41 issues were unchanged.

All counters shed more than 1% during the session. The property sector suffered the most, dropping 79.74 points or 2.42% to close at 3,213.59.

Services fell by 26.34 points or 1.90% to 1,355.15; financials by 23.54 points or 1.35% to 1,713.52; mining and oil by 164.14 points or 1.34% to 12,045.88; industrial by 124.13 points or 1.11% to 11,004.25; and holding firms by 74.69 points or 1.01% to 7,307.96. — Keith Richard D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=&145brexit&8217-trump-uncertainty-spook-local-stocks&id=139231

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion