Top Ten Smart Money Moves – July 13, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 13, 2016 Data)

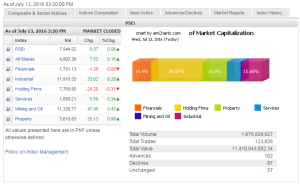

Total Traded Value – PhP 11.411 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 102 Advances vs. 87 Declines = 1.17:1 Neutral

Total Foreign Buying – PhP 6.867 Billion

Total Foreign Selling – (Php 4.405) Billion

Net Foreign Buying (Selling) Php 2.462 Billion – 4th day of Net Foreign Buying after 1 day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

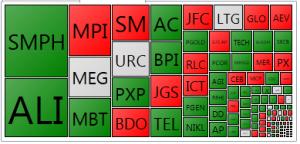

PSE HEAT MAP

Screenshot courtesy of PSEGET

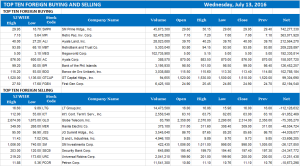

Top Ten Foreign Buying and Selling

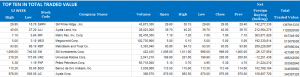

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi revisits 8,000 level on arbitration verdict

Posted on July 14, 2016

STOCKS continued trading upwards yesterday, with the bellwether index surging to the 8,000 level intraday, boosted by the arbitration ruling favoring the Philippines against China in its territorial row over the West Philippine Sea.

The bellwether Philippine Stock Exchange index (PSEi) gained 0.07% or 6.07 points to 7,944.02, its best finish since the 7,958.07 logged last April 27, 2015.

The broader all-shares index rose 0.15% or 7.53 points to 4,803.38.

The PSEi opened slightly higher at 7,951.05 from Tuesday’s close of 7,937.95. It zoomed to an intraday high of 8,005.73 before paring its gains to finish at the day’s lowest level.

The bourse said in a statement that this is the first time the market rallied past the 8,000 mark for this year.

“The last time the PSEi was at the 8,000 level was on April 14, 2015 when the index closed at 8,056.49,” it said.

“Initially, investors took it as a good omen that we won the case. Let’s not forget the US and Asian markets which also traded upwards,” Luis A. Limlingan, managing director at the Regina Capital Development Corp., said in a phone interview.

“We have been trading upwards in the last four days… Just last week, we were at 7,750 intraday. So it’s a 250-point increase in roughly a week.”

“Mainly, macroeconomic wise, the ‘Brexit’ fears were kind of assuaged with the appointment of new UK prime minister. Last week, Fed[eral Reserve] meetings minutes were dovish… And it’s also positive sentiment from the conclusion of the tribunal,” Victor F. Felix, equity analyst at AB Capital Securities, Inc., said.

“The attempt to revisit previous highs is a reflection of continued interest in our stock market. Philippine equities remain to be a favorite among our peers in the region given its resilience during volatile conditions,” PSE President and CEO Hans B. Sicat was quoted as saying in the bourse’s statement. “Interest is also fuelled by the growth prospects of the country, particularly in sectors that are expected to do well based on the priorities of the new administration.”

Property led the charge, posting an increase of 0.98% or 35.13 points to 3,619.83. Mining and oil also rose 0.42% or 47.98 points to 11,326.77; services climbed 0.33% or 5.58 points to 1,656.21; and industrials inched up 0.28% or 33.62 points to 11,918.33.

In contrast, financials declined 0.07% or 1.38 points to 1,791.13 while holding firms dipped 0.31% or 24.29 points to 7,769.80 points.

Both analysts pointed out that investors took profit nearing the market’s close, which caused the decline from Wednesday’s intraday high.

Advancers topped decliners, 102 to 87, while 57 ended unchanged.

Foreigners remained strong buyers with purchases surging P2.46 billion from Tuesday’s net purchases of P963.97 million.

Value turnover was slightly higher at P11.41 billion from Tuesday’s P10.04 billion as 1.88 billion stocks changed hands. — J.C. Lim

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-revisits-8000-level-on-arbitration-verdict&id=130385

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion