Top Ten Smart Money Moves – July 15, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 15, 2016 Data)

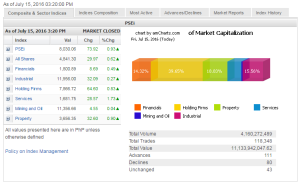

Total Traded Value – PhP 11.134 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 111 Advances vs. 80 Declines = 1.39:1 Neutral

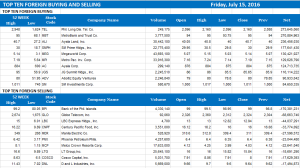

Total Foreign Buying – PhP 6.897 Billion

Total Foreign Selling – (Php 5.033) Billion

Net Foreign Buying (Selling) Php 1.864 Billion – 6th day of Net Foreign Buying after 1 day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

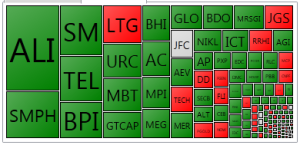

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

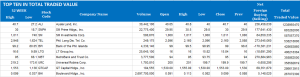

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi rallies past 8,000 to best close in 15 months

Posted on July 17, 2016

Philippine shares rallied following a batch of encouraging news from China and the United Kingdom, lifting the benchmark index to its highest in 15 months.

The Philippine Stock Exchange (PSE) index breached the 8,000 level to settle at 8,030.06 on Friday, its best close since April 2015. That’s a 0.93% gain, or 73.92 points up from Thursday’s session.

“While Asian markets, including ourselves, benefitted from positive news abroad, moving past the 8,000 level shows that investor confidence in our market remains high, and provides some early momentum as companies prepare to disclose their mid-year earnings results in the coming weeks,” PSE President and Chief Executive Officer Hans B. Sicat said in a statement.

The broader all-shares index rose by 0.62% or 29.97 points to 4,841.30.

“Mainly speculation of more stimulus from the Bank of England which basically boosts investor confidence after concerns over Brexit. And there’s the outlook for an improving economy in US and China,” said Unicapital Securities, Inc. Research Head Lexter L. Azurin over the phone.

Profit-taking midday capped the gains after a rally to as much as 8,037.41.

“Excellent performance on Wall Street and with worries in Europe somewhat abating, there are many positive news abroad that continue to boost local market confidence,” Astro C. Del Castillo, managing director at First Grade Finance, Inc., said in a phone interview.

Shares in service firms climbed the most — 1.73% or 28.57 points to 1,681.75.

Property stocks were up 0.90% or 32.60 points to 3,656. 35 points, lifted by Ayala Land, Inc. and SM Prime Holdings, Inc. which added 1.75% and 0.33%, respectively.

All other sub-indices ended in the green.

Advancers beat decliners 111 to 80, while 43 stocks did not move. Value turnover increased to P11.13 billion from Thursday’s P8.21 billion.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-rallies-past-8000-to-best-close-in-15-months&id=130504

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion