Top Ten Smart Money Moves – July 27, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on July 27, 2016 Data)

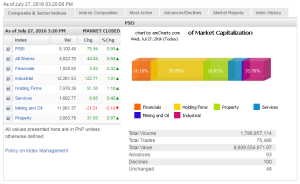

Total Traded Value – PhP 8.610 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 100 Declines vs. 93 Advances = 1.08:1 Neutral

Total Foreign Buying – PhP 5.450 Billion

Total Foreign Selling – (Php 4.444) Billion

Net Foreign Buying (Selling) Php 1.006 Billion – 3rd day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

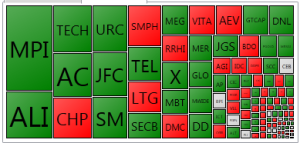

PSE HEAT MAP

Screenshot courtesy of PSEGET

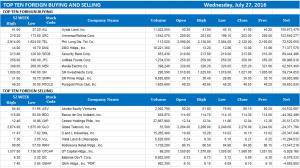

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks rise as positive local data lift sentiment

Posted on July 28, 2016

LOCAL EQUITIES rallied on Wednesday as positive local data boosted investor sentiment ahead of the results of key central bank meetings abroad.

The benchmark Philippine Stock Exchange index jumped 0.94% or 75.94 points to close at 8,100.48 yesterday.

The broader all-shares index also rose 0.93% or 44.84 points to 4,822.70.

“Yesterday (Tuesday) was the imports data. Today (Wednesday), the budget deficit data showed ramped-up spending… and we’re near the window dressing period,” Luis A. Limlingan, managing director at Regina Capital Development Corp., said.

The country’s budget balance swung back to a deficit during the first half on the back of a double-digit rise in expenditures, which is expected to have spurred a faster economic growth for the second quarter.

For the first six months, the budget balance stood at a P120.316-billion deficit, a turnaround from the P13.746-billion surplus posted during the comparable year-ago period, data from the Bureau of the Treasury showed.

Meanwhile, the Philippine Statistics Authority reported on Tuesday that imports rose 39.3% to $6.74 billion in May from $4.83 billion in the same period last year.

Lexter A. Azurin, research head at Unicapital Securities, Inc., said in a phone interview that the market also looked out for corporate earnings, which are projected to be stronger than first-quarter results.

Of all the subindices, only mining and oil ended in negative territory, down by 0.19% or 21.01 points to 11,061.37.

In contrast, the holding firms counter was the biggest gainer, adding 1.15% or 91.38 points to 7,976.39.

Industrials likewise rose 1.01% or 122.71 points to 12,261.53; property climbed 0.87% or 31.83 points to 3,683.78; services increased by 0.40% or 6.65 points to 1,662.77; and financials went up 0.32% or 5.83 points to close at 1,825.93.

Decliners edged out advancers, 100 to 93, while 48 names were unchanged.

Foreigners were net buyers with purchases reaching P1.01 billion, lower than the P1.22-billion net buying seen on Tuesday.

Value turnover reached P8.61 billion, lower than Tuesday’s P9.3 billion, as 1.79 billion shares changed hands.

Southeast Asian stock markets rose on Wednesday, boosted by expectations of fresh stimulus from the Bank of Japan, and ahead of the outcome of the US Federal Reserve policy meeting later in the day.

Japan’s government is likely to inject 6 trillion yen ($56.90 billion) in direct fiscal outlays into the economy over the next few years under a planned stimulus package, double the amount initially planned.

The US Federal Reserve is expected to leave interest rates unchanged when it concludes its two-day meeting on Wednesday as policy makers hold out for more evidence of a pickup in inflation. — with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-rise-as-positive-local-data-lift-sentiment&id=131058

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion