Top Ten Smart Money Moves – June 10, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 10, 2016 Data)

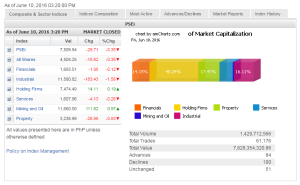

Total Traded Value – PhP 7.828 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 100 Declines vs. 84 Advances = 1.19:1 Neutral

Total Foreign Buying – PhP 3.281 Billion

Total Foreign Selling – (Php 3.660) Billion

Net Foreign Buying (Selling) (Php 0.379) Billion – 1st day of Net Foreign Selling after 12 days of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

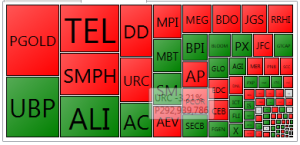

PSE Heat Map

Screenshot courtesy of: PSEGET Software

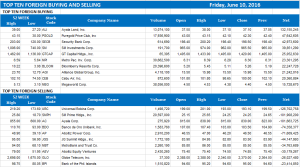

Top Ten Foreign Buying and Selling

and Selling

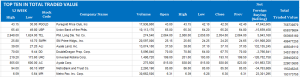

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 12, 2016 06:32:00 PM

Fed meeting seen front and center for investors

LOCAL EQUITIES are expected to trade within a relatively tight range this week, as investors keep watch on the monetary policy meeting in the United States, according to analysts.

The bellwether Philippine Stock Exchange index (PSEi) will likely move within a 7,450-to-7,650 band, BPI Asset Management said in a weekly report, while AB Capital Securities, Inc. Senior Equity Analyst Alexander Adrian O. Tiu expects the main index to trade between 7,300 and 7,600.

“All eyes will be on the Fed as they meet for their June meeting,” BPI Asset Management said.

The US central bank’s policy-making Federal Open Market Committee (FOMC) is scheduled to meet on June 14 and 15.

Recent economic data — particularly the worse-than-expected US job report last week — have bolstered the case against another rate hike in this meeting after the first US interest rate hike in nearly a decade last December.

“But of course we don’t really know. It’s still up in the air and there’s a very slim chance that [the Fed] changes its mind,” Mr. Tiu noted.

Federal Reserve Chair Janet L. Yellen described the May jobs report “disappointing” but, at the same time, gave an upbeat assessment of the US economy.

The PSEi may retreat further ahead of the Fed meeting but bounce back the day after, Mr. Tiu said.

The main index ended 7,509.94 on Friday, losing 4.28 points or 0.06% on the week primarily to profit-taking in the last two trading days of last week.

“The local equities market ended flat as investors locked in gains after several days of rally,” BPI Asset Management said.

Mr. Tiu added that investors are also digging in ahead of the June 23 referendum in the United Kingdom to decide whether the country would remain in the European Union.

“That’s also impacting the markets. That’s definitely one of the factors that people are looking into because a ‘Brexit’ might set a precedent,” the analyst added.

Despite erasing gains from a rally near the 7,800 level by mid-week, the PSEi remained 8.02% above its 6,952.08 finish at end-2015.

Foreign investors also maintained a net buying position last week, subscribing to shares worth P4.62 billion more than they bought.

Value turnover averaged P8.32 billion daily, with 112 stocks advancing, 102 declining and 32 keeping steady last week.

Globally, equities saw range-bound trading for most of last week, given the weak US payrolls data, the dovish statement of Ms. Yellen and recovery of oil prices above $50 per barrel, BPI Asset Management said.

“We expect global equities to trade in range as investors continue to position ahead of the FOMC meeting, and the ‘Brexit’ decision in the coming weeks,” it added.

“Given the disappointment in the non-farm payrolls though, we expect most investors’ risk appetite to be slightly higher.” — Keith Richard D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=fed-meeting-seen-front-and-center-for-investors&id=128853

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion