Top Ten Smart Money Moves – June 14, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 14, 2016 Data)

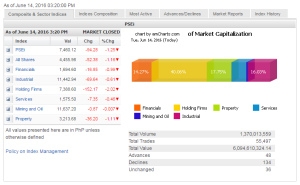

Total Traded Value – PhP 6.095 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 134 Declines vs. 48 Advances = 2.79:1 Bearish

Total Foreign Buying – PhP 2.907 Billion

Total Foreign Selling – (Php 3.213) Billion

Net Foreign Buying (Selling) (Php 0.306) Billion – 3rd day of Net Foreign Selling after 12 days of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

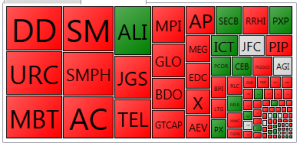

PSE Heat Map

Screenshot courtesy of: PSEGET Software

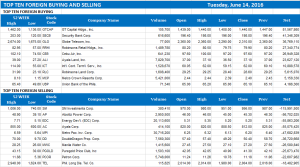

Top Ten Foreign Buying and Selling

and Selling

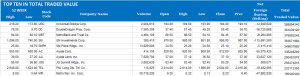

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 14, 2016 08:00:00 PM

By Keith Richard D. Mariano

PSEi drops below 7,500 as ‘Brexit’ concerns rise

LOCAL STOCKS plunged below the 7,500 level on Tuesday as the market consolidated further and tracked global trend driven by the United Kingdom’s looming decision on its exit from the European Union.

Stocks wipe out early losses on bargain huntingFed meeting seen front and center for investorsPSEi continues slide amid profit takingStocks down as investors pocket gains from rallyIndex extends gains as investors pick up shares

The barometer Philippine Stock Exchange index (PSEi) tumbled by 94.28 points or 1.24% to 7.460.12, slightly trimming losses earlier in the trade.

The broader all-shares index, meanwhile, plunged by 52.38 points or 1.16% to 4,455.98.

“We’re still dropping, all the other markets are dropping, too,” Miko A. Sayo, trader at AP Securities, Inc., said in a telephone interview.

Mr. Sayo cited investor concerns about the June 23 referendum in the UK to determine whether it will continue to form part of the EU.

“The EU referendum result can change the economic environment in Europe,” First Grade Finance, Inc. Managing Director Astro C. del Castillo said separately.

Uncertainties over the outcome of the US Federal Reserve’s two-day policy meeting starting late Tuesday further pulled other Southeast Asian stock markets, according to Reuters.

The local market, however, seemed to have already priced in such uncertainties, with most investors expecting the US central bank’s Federal Open Market Committee to leave interest rates unchanged.

The PSEi immediately dropped when trading started on Tuesday, opening at an intraday high of 7,516.68. The index plunged to as low as 7,414.37.

All counters ended in the red, with holding firms dropping by 152.17 points or 2.01% to 7,388.60.

Property stocks declined by 36.20 points or 1.11% to 3,213.68; financials by 16.85 points or 0.98% to 1,694.60; industrial by 69.64 points or 0.60%; services by 7.35 points or 0.46%; and mining and oil by less than a point to 11,637.20.

The value turnover decreased to P6.09 billion from the P7.22 billion recorded on Monday, after 1.37 billion shares exchanged hands.

The market saw 134 stocks decline, 48 advance and 36 remain unchanged.

Foreign investors continued to dump shares, even as net foreign selling dropped to P306.03 million yesterday from Monday’s P430.26 million.

“We’re approaching oversold levels, with tomorrow’s trading possibly dragging the stocks to a short-term bottom,” AP Securities’ Mr. Sayo said.

DA Market Securities, Inc. Chief Equity Analyst Nisha S. Alicer, meanwhile, pegged the support at the 7,200 to 7,350 levels and the resistance at the 7,700 to 7,800 lines amid a continued consolidation.

“Should there be no surprises such as a rate hike or a ‘Brexit’ we feel the market can sustain levels. However, we will need to see positive second-quarter results to see a more bullish move thereafter,” Ms. Alicer said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-drops-below-7500-as-&145brexit&8217-concerns-rise&id=128967

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion