Top Ten Smart Money Moves – June 2, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 2, 2016 Data)

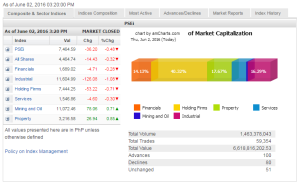

Total Traded Value – PhP 6.619 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 100 Advances vs. 80 Declines = 1.25:1 Neutral

Total Foreign Buying – PhP 3.562 Billion

Total Foreign Selling – (Php 3.326) Billion

Net Foreign Buying (Selling) Php 0.236 Billion – 7th day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

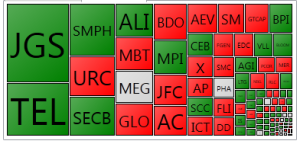

PSE Heat Map

Screenshot courtesy of: PSEGET Software

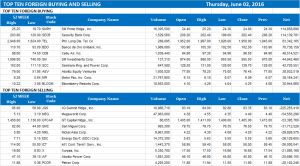

Top Ten Foreign Buying and Selling

and Selling

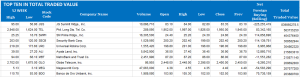

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 02, 2016 08:43:00 PM

Shares drop as investors pocket gains from rally

THE LOCAL barometer made a last-minute retreat on Thursday, after investors took profits from the previous session’s rally amid weak key economic data releases out of US and China.

The Philippine Stock Exchange index (PSEi) declined 36.20 points or 0.48% to close at 7,464.59.

The broader all-shares index, meanwhile, dropped 14.43 points or 0.32% to 4,464.74.

The main index was tracking an upward trend earlier in the day — rising to 7,506.78 when the market opened and reaching a high of 7,553.6 — before closing at its lowest level for the session.

“Things turned in the opposite direction at the runoff, with sellers dominating the close to pull the measure lower,” Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., said in a report.

Property stocks, along with mining and oil, managed to remain in the positive territory on Thursday. The property index rose 26.94 points or 0.84% to 3,216.58, while mining and oil gained 78.06 points or 0.71% to 11,072.46.

Industrial stocks led the decline, losing 126.08 points or 1.07% to close at 11,604.99. Financials declined 4.71 points or 0.27% to end at 1,689.02; holding firms by 53.22 points or 0.71% to finish at 7,444.25; and services by 4.60 points or 0.29% to close at 1,546.86.

In separate phone interviews, DA Market Securities, Inc. chief equity analyst Nisha S. Alicer and AB Capital Securities, Inc. analyst Alexander Adrian O. Tiu also attributed the market’s turnaround partly to profit taking.

Ms. Alicer, however, described the stock market’s performance as “tentative” as investors await developments from the pending “Brexit” vote and the meeting of the US Federal Reserve in June.

“Locally, there’s good news. Investors have given a welcome reception for the incoming president, who has presented very positive policies and plans for the country,” Ms. Alicer said.

AB Capital’s Mr. Tiu, meanwhile, noted that there was some risk aversion ahead of the release of key economic numbers, including jobs data from the US.

Weak data and the upcoming US Federal Reserve meeting has been hanging over the head of investors as confidence fluctuates,” A&A’s Mr. Calaycay said.

Value turnover decreased to about P6.62 billion yesterday after 1.46 billion stocks exchanged hands.

Advancers outnumbered decliners, 100 to 80, while 51 stocks were unchanged. Net foreign buying dropped to P235.77 million from the previous session’s P468.08 million.

“The weak closing once more casts doubts on the sustainability of rallies, validating resistance at the 7,460-70 levels,” Mr. Calaycay noted.

Southeast Asian stocks rose on Thursday, with Thailand leading the gainers after its central bank kept the key policy rate steady.

Asian shares however eased after surveys showed global manufacturing activity and demand remain weak. — Keith Richard D. Mariano with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=shares-drop-as-investors-pocket-gains-from-rally&id=128467

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion