Top Ten Smart Money Moves – June 21, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 21, 2017 Data)

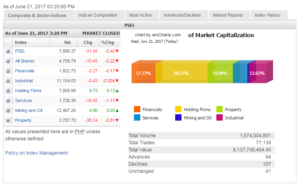

Total Traded Value – PhP 8.138 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 107 Declines vs. 94 Advances = 1.14:1 Neutral

Total Foreign Buying – PhP 4.398 Billion

Total Foreign Selling – (PhP 4.061) Billion

Net Foreign Buying (Selling) – PhP 0.337 Billion – 1st day of Net Foreign Buying after 2 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

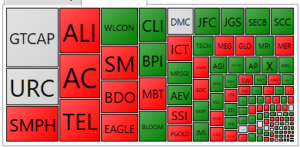

PSE HEAT MAP

Screenshot courtesy of PSEGET

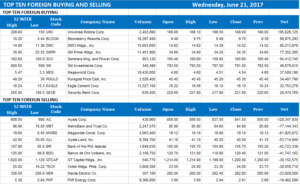

Top Ten Foreign Buying and Selling

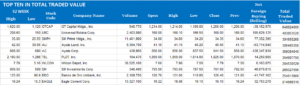

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Local stocks tank on drop in oil, MSCI’s China call

Posted on June 22, 2017

THE Philippine Stock Exchange index (PSEi) barely budged on Wednesday, falling by 31.49 points or 0.39% to 7,886.37 to extend its losses for a second straight session.

It tracked emerging equities that languished for a second day following a drop in oil and amid worries that Asian markets could see investment outflows as a result of MSCI’s decision to include China in a benchmark share index.

“Due to lack of positive news and pleasant surprises, PSEi loses steam in breaching 8,000 and peaking,” said Alexis Cabel, research head and cofounder of Corpecon Data Research Services.

He expects support to mirror the level reached by the main index in January and February this year.

Jonathan L. Ravelas, BDO Unibank, Inc. chief market strategist, said the market had remained range-bound, with the PSEi moving between 7,700 and 8,000 levels.

Harry G. Liu, president of Summit Securities, Inc., expects the index’s support at between 7,650 and 7,700 while the resistance at 8,000 to 8,020.

Overseas, a number of indicators came out unfavorably for local stocks, said Luis A. Limlingan, business development head at Regina Capital Development Corp.

“Shares were dragged down with US stocks declining, oil prices slumping into a bear market, and the unexpected inclusion of China’s A-shares into the MSCI index,” he said. “Crude futures sank to a 10-month low amid worries of a supply glut. West Texas Intermediate (WTI) was down 2% to $43.23/barrel in Nymex — the lowest since August,” he added.

Index provider MSCI had announced that China’s domestic A-shares would be included in the equity index, a move that could result in an estimated $81 billion in potential inflows to onshore equities in the coming years.

“As such, inclusion is unlikely to result in a significant shift in the underlying flow picture, in our view,” he said.

Along with PSEi, the wider all-shares index slipped by 10.45 points or 0.22% to finish at 4,708.79.

Losers outnumbered gainers at 107 to 94, while 41 stocks finished unchanged. Value turnover improved to P8.14 billion, up 15% from P7.08 billion the other day.

Services led the losing sectors as the sub-index gave up 19.45 points or 1.11% to close at 1,726.38. Property was down 30.14 points or 0.80% to 3,707.73, financials slipped by 3.27 points or 0.17% to 1,922.73 while industrials finished unchanged at 11,154.03.

Holding firms gained 9.73 points or 0.12% to 7,809.99, while the mining and oil index rose by 4.06 points or 0.03% to 12,497.26.

Yesterday’s session ended with foreign funds reverting to being net buyers of local shares at P337 million. They were net sellers the other day at P374.78 million.

GT Capital Holdings, Inc. led the most active stocks with a total trading value of P649 million. Universal Robina Corp., SM Prime Holdings, Inc., Ayala Land, Inc. and Ayala Corp. rounded out the top five. — Victor V. Saulon with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=local-stocks-tank-on-drop-in-oil-msci&8217s-china-call&id=147115

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion