Top Ten Smart Money Moves – June 22, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 22, 2018 Data)

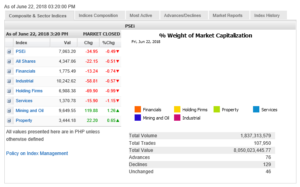

Total Traded Value – PhP 8.050 Billion – Medium

Advances Declines – (Ideal is 2:1) 129 Declines vs. 76 Advances = 1.70 Neutral

Total Foreign Buying PhP 3.796 Billion

Total Foreign Selling – (PhP 5.205) Billion

Net Foreign Buying (Selling) (PhP 1.409) Billion – 26th day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

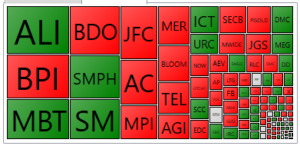

PSE HEAT MAP

Screenshot courtesy of PSEGET

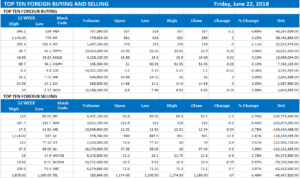

Top Ten Foreign Buying and Selling

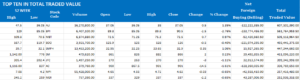

Top Ten in Total Traded Value

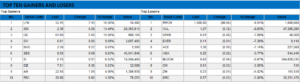

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Bourse sinks deeper as gloom persists

June 22, 2018 | 7:41 pm

THE BOURSE sank deeper on Friday after straying briefly into positive territory moments before closing, marking what an analyst noted was one of the market’s steepest weekly falls in recent history.

The market has recently been reeling from both domestic and foreign developments — a worsening, spreading trade war between the United States on the one hand and China, the European Union and lately India on the other, as well as rising inflation, a nagging current account deficit and a weakening peso at home — that sent it officially into bear territory on Thursday, falling more than 20% from the year’s peak so far.

Unlike Thursday however, which saw all six sectoral indices end lower, two managed to claw their way back from the red on Friday.

The Philippine Stock Exchange index (PSEi) closed 34.95 points or 0.49% lower at 7,063.2 — down 6.19% on the week and 17.47% from end-2017 — while the all-shares index gave up 22.15 points or 0.51% to end 4,347.06.

PSEi — which fell to a low of 6,923.67 and a high of 7,132.71 on Friday — remained a bear market, down 22% from its peak so far this year at a 9,058.62 finish on Jan. 29.

“The PSEi looked to be headed into another bloodbath as it opened in the red and blitzed past major support at 7,000, sinking 2.46% to a low of 6,923.67 just 30 minutes into the session,” RCBC Securities, Inc. said in a Stock Market Weekend Recap prepared by Research Analyst Fiorenzo D. De Jesus.

“However, the bulls came to the rescue and managed to push the index back into the green by the afternoon,” he added.

“Selling at the close dragged the composite back into the red at 7,063.20, 34.95 pts or 0.49% lower, although it ended above the 7,000 support.”

Asked for comment, Timson Securities Inc. Equity Trader Jervin S. De Celis noted in a mobile phone message that “[t]he PSEi is still bearish as major support levels have been broken down due to the absence of strong local catalysts.”

“Investors are also worried about the escalating trade tension between China and the US. The Eurozone and India also announced their plan to impose tariffs on some US goods and I think this smothers market sentiment,” he added.

“I also think that the weakness of the peso and the wider current account deficit are turning off investors, but I guess the market will find support once we see developments in the second package of the TRAIN bill as well as the groundbreaking of the major infrastructure projects later this year,” he continued, referring to the Tax Reform for Acceleration and Inclusion whose second package — now in the House of Representatives — seeks to slash corporate income tax rates to Southeast Asian levels but at the same time remove fiscal incentives the government deems redundant.

The first package — Republic Act No. 10963 — which slashed personal income tax rates but raised or added taxes on several items and removed certain value added tax exemptions helped fuel PSEi’s 10 record highs in January after coming into force as 2018 began.

Noting that “Philippine stocks fell below the 7,000 level for the first time this year,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said in a mobile message that “bargain hunting kept the market from sliding much further.”

“Still, the PSEi ended more than -5% down this week, which is one biggest in recent trading history,” Mr. Limlingan added, noting that “local issues were sold down heavily in the morning” particularly as “US stocks closed solidly lower on Thursday, with major indexes suffering one of their worst sessions of the month…”

Reuters noted that the Dow Jones Industrial Average fell for an eight straight session, giving up 0.80% to finish 24,461.7, while the Nasdaq Composite Index and the S&P 500 dropped 0.88% to 7,712.95 and by 0.63% to 2,749.76, respectively.

Asian markets were a mixed bunch, with Japan’s Nikkei 225 and TOPIX Index and the MSCI AC Asia Pacific falling by 0.78% to 22516.83, 0.33% to 1,744.83 and by 0.46% to 169.02, respectively, and Hong Kong’s Hang Seng, the Shanghai SE Composite index and the blue-chip Shanghai-Shenzhen’s CSI 300 gaining 0.15% to 29338.7, 0.49% to 2889.952 and 0.44% to 3,608.90, respectively.

Back home, four sectoral indices closed lower: services by 15.9 points or 1.14% at 1,370.78, holding firms by 69.9 points or 0.99% at 6,988.38, financials by 13.24 points or 0.74% at 1,775.49 and industrials by 58.81 points or 0.57% at 10,242.62.

The remaining two managed to end Friday with gains: mining and oil by 119.88 points or 1.25% at 9,649.55 and property by 22.2 points or 0.64 at 3,444.18.

Local stocks that lost outnumbered those that gained 129 to 76, while 46 others steadied.

Friday’s list of 20 most active stocks showed 13 that ended lower, led by Bloomberry Resorts Corp. that fell by 5.67% to P9.81 apiece, Megawide Construction Corp. that dropped 2.78% to P21, Bank of the Philippine Islands that gave up 2.76% to P88 and Alliance Global Group, Inc. that also went down by 2.76% to P12 each.

The seven others that gained were led by Universal Robina Corp. that increased by 1.95% to P115 apiece; Ayala Land, Inc. that rose by 1.35% to P37.55 and SM Prime Holdings, Inc. that went up by 1.06% to P33.25 each.

Trading thinned slightly to 1.837 billion shares worth P8.05 billion from Thursday’s 1.914 billion shares worth P7.893 billion.

Foreigners largely continued to dump shares, though net selling fell 37.79% to P1.41 billion as overall selling slipped 3.81% to P5.205 billion and overall buying gained a fifth to P3.796 billion.

The week saw some P6.6 billion in foreign selling, RCBC Securities noted, while daily turnover averaged P6.7 billion, “lifted by more active trading” after the Bangko Sentral ng Pilipinas (BSP) on Wednesday lifted policy interest rates for a second straight month and for the second time in nearly four years in the face of rising inflation that has breached the BSP’s 2-4% full-year 2018 target range at 4.1% in the five months to May.

“Foreign investors are still on a selling spree as risky assets become less attractive compared to safer instruments like bonds,” Timson Securities’ Mr. De Celis noted. — quotes by Janina C. Lim

Source: http://bworldonline.com/bourse-sinks-deeper-as-gloom-persists/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.