Top Ten Smart Money Moves – June 29, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 29, 2017 Data)

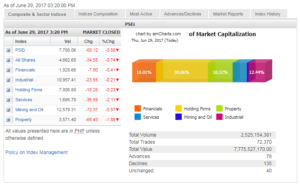

Total Traded Value – PhP 7.776 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 135 Declines vs. 78 Advances = 1.73:1 Neutral

Total Foreign Buying – PhP 4.287 Billion

Total Foreign Selling – (PhP 4.168) Billion

Net Foreign Buying (Selling) – PhP 0.119 Billion – first day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

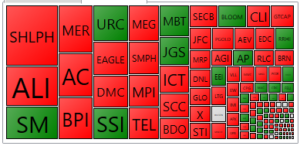

PSE HEAT MAP

Screenshot courtesy of PSEGET

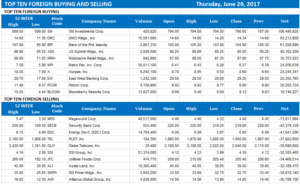

Top Ten Foreign Buying and Selling

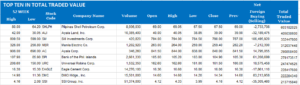

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

All sectoral indices drag bourse down further

Posted on June 30, 2017

LOCAL SHARES failed to mirror Wall Street’s gains, despite the expected seasonal window-dressing by fund managers.

“For the last two years, window-dressing is non-existent anymore,” said Miko S. Sayo, trader at Angping & Associates Securities, Inc.

“I think we are getting affected by the weak peso. Also, it’s just the season to be bearish,” he added.

But for Joseph Y. Roxas, president of Eagle Equities, Inc., the impact of end-semester window-dressing will still be felt on Friday.

On Thursday, the Philippine Stock Exchange index (PSEi) gave up 69.12 points or 0.88% to close at 7,788.06, while the broader all-shares index also slipped, giving up 34.55 points or 0.73% to finish 4,662.65. All six sectoral indices ended trading negatively.

Harry G. Liu, president of Summit Securities, Inc., said the PSEi “technically broke short-term support.” He added that there was no “fundamental catalyst” to move the market higher.

Luis A. Limlingan, business development head at Regina Capital Development Corp., said Philippine markets failed to match US equities’ march that was led by banks and technology stocks. “The technology sector rebounded strongly following signs of the end-of-a-cycle correction ending,” he noted.

Locally, services led losers with a drop of 36.59 points or 2.11% to finish at 1,695.78. Property stocks followed with a decline of 68.43 points or 1.88% to 3,571.40, mining and oil lost 72.37 points or 0.57% to 12,579.31, financials slipped 7.9 points or 0.40% to 1,928.66, holding firms went down 18.28 points or 0.23% to 7,808.88, while industrial issues finished 23.55 points or 0.21% lower at 10,957.41.

Trading value was at P7.78 billion, up 17% from Wednesday’s P6.64 billion.

Advancers lagged behind losers for the third day in a row at 78 to 135, while 40 shares finished unchanged.

Foreign funds yesterday ended three straight days of net selling with P118.61 million worth of net purchases that were a turnaround from Wednesday’s P198.74-million net selling.

Cityland Development Corp. was yesterday’s top gainer as its shares climbed 12.75% or 0.19 points to finish P1.68 each.

Rounding out the top five in this regard were City & Land Developers, Inc.; Grand Plaza Hotel Corp.; Vantage Equities, Inc. and Manila Jockey Club, Inc.

The top losers were Omico Corp.; BHI Holdings, Inc.; MJC Investments Corp.; Lorenzo Shipping Corp. and Mabuhay Holdings Corp.

Yesterday’s most active stocks were led by Pilipinas Shell Petroleum Corp. (down 2.17% to P67.50 per share); Ayala Land, Inc. (down 2.26% to P39 apiece); SM Investments Corp. (up 0.38% to P790); Manila Electric Co. (down 1.07% to P259.40); and Ayala Corp. (down 0.18% to P840 each). — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=all-sectoral-indices-drag-bourse-down-further&id=147529

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion