Top Ten Smart Money Moves – June 6, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 6, 2017 Data)

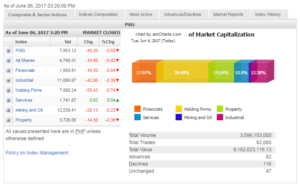

Total Traded Value – PhP 8.182 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 115 Declines vs. 83 Advances = 1.39:1 Neutral

Total Foreign Buying – PhP 3.934 Billion

Total Foreign Selling – (PhP 3.738) Billion

Net Foreign Buying (Selling) – PhP 0.196 Billion –8th day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

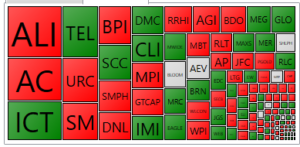

PSE HEAT MAP

Screenshot courtesy of PSEGET

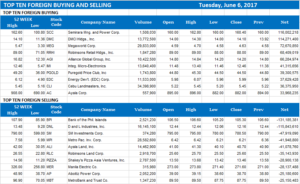

Top Ten Foreign Buying and Selling

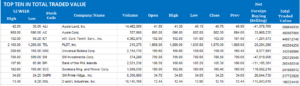

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks decline anew as investors turn cautious

Posted on June 07, 2017

STOCKS slipped from the fresh high logged on Monday as investors turned cautious ahead of key events offshore and amid a rift between Qatar and Arab states.

After reaching its highest level so far this year last Monday, the Philippine Stock Exchange index on Tuesday slipped by 48.26 points or 0.60% to finish at 7,953.12, largely influenced by what transpired in foreign markets, analysts said.

The broader all shares index retreated by 19.96 points or 0.41% to close at 4,740.31.

“I believe the market retreated as a knee-jerk reaction on the latest news of Middle East countries severing ties with Qatar,” said Katrine Eunice L. Dolatre, investment analyst-equity research, F. Yap Securities, Inc. “Thus far, the administration stated that the Philippines is maintaining its diplomatic ties, but investors might want to wait on further actions revolving the situation, given that a number of overseas Filipinos are working in Qatar.”

The Arab world’s biggest powers cut ties with Qatar on Monday, accusing it of support for Islamist militants and Iran, and reopening a festering wound two weeks after US President Donald J. Trump’s demand for Muslim states to fight terrorism.

Saudi Arabia, Egypt, the United Arab Emirates and Bahrain severed diplomatic relations with Qatar in a coordinated move. Yemen, Libya’s eastern-based government and the Maldives joined later.

She also pointed to the lack of catalysts that could have pushed stocks higher.

“The local market took a breather after reaching a high for the year. It was also tracking US stocks closing marginally lower as investor turned cautious ahead of a week packed with former FBI (Federal Bureau of Investigation) director James Comey’s testimony, the UK (United Kingdom) election, and the ECB (European Central Bank) monetary policy meeting,” said Luis A. Limlingan, business development head at Regina Capital Development Corp.

Harry G. Liu, president of Summit Securities, Inc., added that the market was continuing to consolidate. “I expect the market will be more positive,” he said, saying the crisis in Mindanao is starting to clear up.

All sectoral indices were in the red save for services, which inched up by 0.62 points or 0.03% to close at 1,741.87. Financials led the decline as it dropped 0.83% or 16.50 points to 1,959.81, followed by holding firms, which gave up 0.73% or 58.43 points to end at 7,895.24. Industrials went down 0.38% or 42.96 points to 11,069.97; property dropped 0.38% or 14.36 points to 3,726.06; and mining and oil lost 0.23% or 29.13 points to 12,539.41.

Trading value yesterday was at P8.18 billion, down from P8.65 billion on Monday, with 3.1 billion shares changing hands.

Decliners outnumbered advancers, 116 to 82, while 47 names finished unchanged.

Foreign funds bought more shares than they sold, resulting in a net foreign buying of P196.2 million, lower than the previous day’s net inflow worth P965.16 million. — VVS with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-decline-anew-as-investors-turn-cautious&id=146350

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion