Top Ten Smart Money Moves – June 7, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 7, 2016 Data)

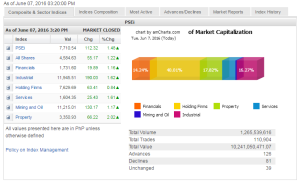

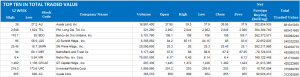

Total Traded Value – PhP 10.241 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 126 Advances vs. 81 Declines = 1.56:1 Neutral

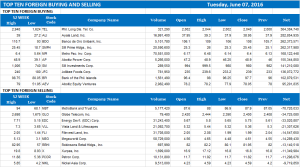

Total Foreign Buying – PhP 6.044 Billion

Total Foreign Selling – (Php 3.594) Billion

Net Foreign Buying (Selling) Php 2.450 Billion – 10th day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

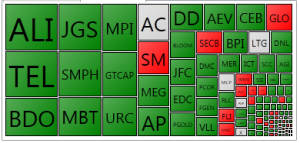

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 07, 2016 08:05:00 PM

PHL shares extend climb as Yellen turns dovish

LOCAL STOCKS further advanced on Tuesday to reach their highest level in over a year, after US Federal Reserve Chair Janet L. Yellen kept an upbeat outlook on the world’s largest economy despite weak jobs data.

The benchmark Philippine Stock Exchange index (PSEi) rallied by 112.32 points or 1.47% to 7,710.54.

This is its highest reading since the benchmark index’s 7,728.50 close on May 26, 2015.

The main index closed above the 7,700 level for the first time this year, gaining a total of 758.46 points or 10.91% in 2016 thus far, according to data from the local bourse.

The broader all-shares index, meanwhile, climbed 55.17 points or 1.21% to 4,584.63.

“It was triggered by Fed Chair Yellen’s comment that interest rate hikes will be gradual,” Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said in a telephone interview.

The PSEi immediately rose to 7,645.35 when the market opened. The index then managed to more than double its opening gains to reach a high of 7,744.54 within the first hour of trading.

The stock barometer later dropped some gains, even sliding to an intraday low of 7,634.38 before regaining its footing.

All counters ended in the green, with property stocks leading the charge, adding another 66.22 points or 2.01% to close at 3,350.93.

Industrial rose by 190.03 points or 1.61% to 11,945.51; services by 25.43 points or 1.61% to 1,604.35; mining and oil by 130.17 points or 1.17% to 11,215.01; financials by 19.89 points or 1.16% to 1,731.60; and holding firms by 63.41 points or 0.83% to 7,629.69.

Value turnover increased to P10.24 billion after 1.27 billion shares exchanged hands from Monday’s P7.16 billion.

Advancers trumped decliners, 126 to 81, while 39 stocks were unchanged.

Net foreign buying surged to P2.45 billion from the previous session’s P429.62 million.

Ms. Yellen’s generally upbeat assessment of the US economy late Monday also buoyed other Asian stocks to a five-week high yesterday, according to a Reuters report.

The Fed chair, who downplayed the weak payrolls data released over the weekend,provided a “clear argument” for an interest rate hike, Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., noted in a report.

“Although a rate hike has, in the past, been a negative impetus, what it implies in the present — the economy has gained sufficient strength to withstand higher borrowing costs — elicits confidence,” Mr. Calaycay added.

Investors may remain cautious but more bullish in the next trading days, with the possibility of the US central bank raising interest rates during its policy meeting next week already diminished, IB Gimenez’s Ms. Telagen noted.

“The successive days of gain, however, introduces the possibility of a profit-taking driven correction possibly before the week is up,” A&A’s Mr. Calaycay said. — Keith Richard D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=phl-shares-extend-climb-as-yellen-turns-dovish&id=128641

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion