Top Ten Smart Money Moves – June 8, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 8, 2016 Data)

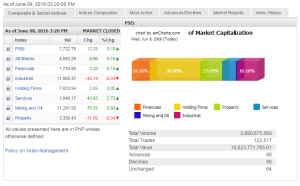

Total Traded Value – PhP 10.024 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 90 Advances vs. 86 Declines = 1.05:1 Neutral

Total Foreign Buying – PhP 5.605 Billion

Total Foreign Selling – (Php 3.673) Billion

Net Foreign Buying (Selling) Php 1.932 Billion – 11th day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

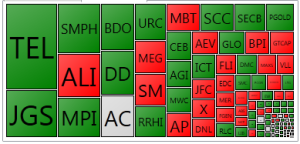

PSE Heat Map

Screenshot courtesy of: PSEGET Software

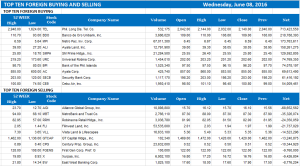

Top Ten Foreign Buying and Selling

and Selling

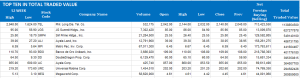

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 08, 2016 08:14:00 PM

Index extends gains as investors pick up shares

THE LOCAL stock barometer managed to extend gains on Wednesday, as foreign investors bought more equities amid profit taking in the property and industrial sectors.

The Philippine Stock Exchange index (PSEi) settled 12.25 points or 0.15% higher at 7,722.79.

Yesterday’s closing level, however, was the lowest point the main index touched during the session.

The PSEi extended its ascent in morning trade, opening at 7,724.26 and reaching a high of 7,792.34 before the local stock market went into recess.

The broader all-shares index exhibited the same trend, closing at 4,593.29 after gaining 8.66 points or 0.18%.

“We actually closed high in the previous sessions. I think this prompted a little bit of profit taking,” Nisha S. Alicer, chief equity analyst at DA Market Securities, Inc., said in a telephone interview.

Other Southeast Asian stocks also succumbed to profit-taking on Thursday, after advancing on the back of diminished prospects for another interest rate hike in the United States.

Profit-taking was particularly observed in the property and industrial sectors, which gained most from the previous sessions’ rally toward the 7,700 level, Aniceto K. Pangan, trader at Diversified Securities, Inc., said in a separate interview.

At the close of yesterday’s session, the property sub-index dropped by 11.50 points or 0.33% to 3,339.43 while industrial stocks retreated by 40.14 points or 0.34% to 11,905.37.

Other counters continued to advance, with services surging by 43.82 points or 2.73% to 1,648.17. Mining and oil likewise rose by 76.55 points or 0.68% to 11,291.56; financials gained 3.20 points or 0.18% to 1,734.80; and holding firms went up by 3.85 points or 0.05% to 7,633.54.

At the same time, the uptrend in stocks attracted more bets from foreign investors, DA Market’s Ms. Alicer noted, even as net foreign buying went down to P1.93 billion from Tuesday’s P2.45 billion.

More than 2.08 billion shares worth P10.02 billion were traded on Wednesday, down slighty from the previous session’s P10.24 billion.

Advancers outnumbered decliners, 90 to 86, while 64 stocks were unchanged.

Ms. Alicer and Mr. Pangan expect local stocks to maintain an upward trend moving forward, with downside pressure coming from a possible profit-taking along the way.

“I think that technically we can try 7,900 to 8,000 moving forward with the support placed at 7,400 to 7,500 now,” DA Market’s Ms. Alicer said.

Investors are keeping an upbeat prospect on Philippine corporations given the “positive scenarios” the incoming administration has painted through its eight-point economic agenda, Diversified’s Mr. Pangan said.

“Unfortunately, the US market is almost at its highest level so [investors] do profit-taking at the latter part of the trade,” the trader added. — Keith Richard D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=index-extends-gains-as-investors-pick-up-shares&id=128710

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion