Top Ten Smart Money Moves – Mar. 1, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Mar. 1, 2016 Data)

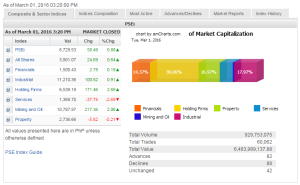

Total Traded Value – PhP 6.484 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 88 Declines vs. 82 Advances = 1.07:1 Neutral

Total Foreign Buying – PhP 3.743 Billion

Total Foreign Selling – (Php 3.241) Billion

Net Foreign Buying (Selling) – Php 0.502 Billion – 1st day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

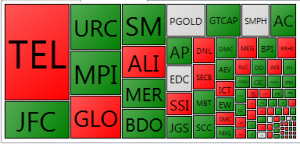

PSE Heat Map

Screenshot courtesy of: PSEGET Software

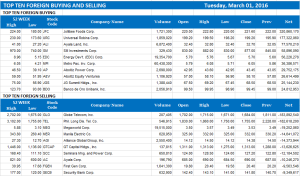

Top Ten Foreign Buying and Selling

and Selling

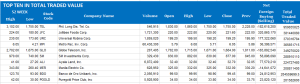

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on March 01, 2016 08:51:00 PM

By Krista A. M. Montealegre, Senior Reporter

Stocks rebound on China move to boost growth

EQUITIES recovered yesterday, getting a lift from China’s decision to ease monetary policy, even as the slump of index heavyweight Philippine Long Distance Telephone Co. (PLDT) continued.

The benchmark Philippine Stock Exchange index (PSEi) climbed 58.49 points or 0.87% to close at 6,729.53, near the session’s peak. The local barometer declined 1.48% on Monday following the bloodbath in PLDT.

The all-shares index rose 24.69 points or 0.63% to finish at 3,901.07.

“Moves of China on boosting its economy encouraged more investors to go back to the market. Fresh news on earnings and corporate developments gave confidence to investors,” Astro C. del Castillo, managing director at First Grade Finance, Inc., said in a telephone interview.

On Monday, the People’s Bank of China (PBoC) said on its Web site that it trimmed the amount of cash that banks must hold as reserves by 50 basis points in an effort to cushion deteriorating economic conditions.

The move of China’s central bank was followed by the release of sluggish economic data yesterday showing that its official manufacturing purchasing managers’ index (PMI) dropped to 49 in February, shrinking for the seventh straight month. A reading below 50 indicates a contraction.

A separate private gauge, the Caixin/Markit China manufacturing PMI, fell to 48 last month from 48.4 in the prior month.

“Investor sentiment was driven by the surprise reserve requirement cut by the PBoC despite the continuing drag of PLDT after reporting disappointing earnings for the full-year 2015,” Joylin F. Telagen, equity analyst at IB Gimenez Securities, Inc., said in a mobile phone message.

After plunging 17.86% on Monday, investors dumped shares in dominant telco PLDT anew, losing another 4.10% to P1,755 each yesterday. This dragged the services sub-sector by 37.79 points or 2.68% to 1,369.70.

Another counter in the red was property, which shed 5.82 points or 0.21% to 2,736.66.

In contrast, holding firms rallied 171.46 points or 2.69% to 6,539.19; mining and oil surged 217.36 points or 2.05% to 10,787.97; industrial went up 100.82 points or 0.90% to 11,210.36; and financials added 2.78 points or 0.18% to 1,500.43.

Value turnover slipped to P6.48 billion after 929.75 million shares changed hands, from the P8.49 billion logged the previous session. Market breadth was negative, as decliners beat advancers, 88 to 82, while 42 issues were unchanged.

Foreigners reversed their position, with net purchases of P502.48 million — a turnaround from the net sales of P606.41 million.

“Despite the gains, the market is still cautious highlighted by the equal number of gainers and losers because the external concerns remain,” First Grade Finance’s Mr. del Castillo said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-rebound-on-china-move-to-boost-growth&id=123866

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion