Top Ten Smart Money Moves – Mar. 2, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Mar. 2, 2016 Data)

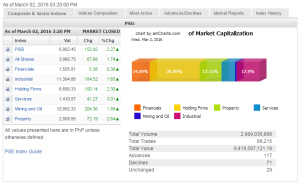

Total Traded Value – PhP 9.410 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 117 Advances vs. 71 Declines = 1.65:1 Neutral

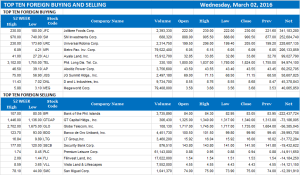

Total Foreign Buying – PhP 5.058 Billion

Total Foreign Selling – (Php 4.010) Billion

Net Foreign Buying (Selling) – Php 1.048 Billion – 2nd day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

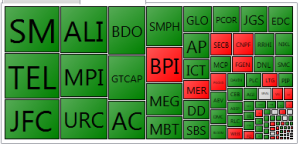

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

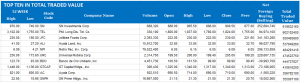

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on March 02, 2016 09:21:00 PM

By Krista A. M. Montealegre, Senior Reporter

Index surges on Wall St. rally, positive earnings

THE BELLWETHER Philippine Stock Exchange index (PSEi) roared its way towards the 6,900 mark yesterday, closing at its highest level this year, as risk appetite improved following the overnight strength in US stocks and as more companies report their financial results.

The benchmark PSEi rallied 152.92 points or 2.27% to end at the session’s high of 6,882.45, its highest level since Dec. 29, 2015. The local barometer trimmed its year-to-date decline to only 1% from a peak of 12.45% last month.

The all-shares index surged 67.68 points or 1.73% to finish at 3,968.75.

“PLDT (Philippine Long Distance Telephone Co.) went up and US stocks were up too. Concerns are easing and maybe those concerns are unfounded in the first place,” Joseph Y. Roxas, president of Eagle Equities, Inc., said in a phone interview.

In Wall Street, US benchmark indices rose by at least 2% each, encouraged by a report that manufacturing activity in the world’s largest economy shrank less than forecast in February and spending on construction projects increased the most since May.

Global stock markets are still riding on the move of China’s central bank to free more money for lending by cutting the amount banks must hold in reserve to boost deteriorating growth.

Meanwhile, shares in index heavyweight PLDT took a breather from a two-day sell-off, rising 3.93% to close at P1,824.00 each yesterday.

“The general sentiment is really bullish. We have been resilient to external factors compared to regional indices, and if it weren’t for a lack of faith in the index, we would have been up in the past few months. People are realizing how resilient the index is,” Victor F. Felix, equity analyst at AB Capital Securities, Inc., said in a separate interview.

All counters closed in the green. Services led the charge with a gain of 41.27 points or 3.01% to 1,410.97. Property advanced 72.19 or 2.63% to 2,808.85; holding firms climbed 150.14 points or 2.29% to 6,689.33; mining and oil went up 204.36 points or 1.89% to 10,992.33; industrial rose 184.52 points or 1.64% to 11,394.88; and financials jumped 5.38 points or 0.35% to 1,505.81.

The sharp gains were accompanied by strong volumes, with value turnover increasing to P9.42 billion after 2.99 billion shares changed hands, from Tuesday’s P6.48 billion.

Advancers dominated decliners, 117 to 71, while 29 issues closed flat.

Net foreign buying accelerated to P1.05 billion from the P502.48 million logged on Tuesday.

Stocks may succumb to profit-taking after breaching resistance levels, Eagle Equities’ Mr. Roxas said.

“If earnings are in line with expectations, we may hit 7,200 or 7,300 by April, but coming into May, investors may pull out ahead of the elections,” AB Capital’s Mr. Felix said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=index-surges-on-wall-st.-rally-positive-earnings&id=123941

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion