Top Ten Smart Money Moves – May 10, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 10, 2017 Data)

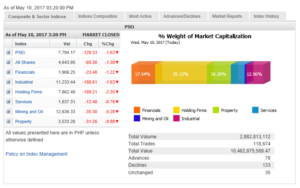

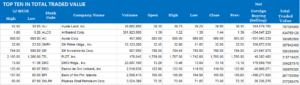

Total Traded Value – PhP 10.463 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 133 Declines vs. 78 Advances = 1.71:1 Neutral

Total Foreign Buying – PhP 4.902 Billion

Total Foreign Selling – (PhP 4.362) Billion

Net Foreign Buying (Selling) – PhP 0.540 Billion – 7th day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

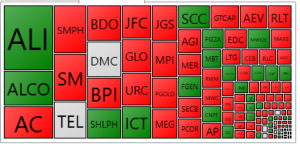

PSE HEAT MAP

Screenshot courtesy of PSEGET

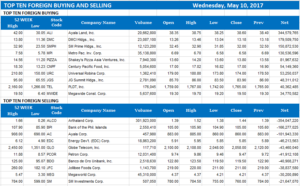

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi extends losses, sinks further below 8,000

By Imee Charlee C. Delavin,

Senior Reporter

Posted on May 11, 2017

STOCKS fell to drag the Philippine Stock Exchange index (PSEi) to a five-day low, and further away from 8,000 level, as blue chip company earnings disappointed.

The bellwether index ended in the red for a second straight session as it declined 1.63% or 129.33 points to close at 7,794.17. The broader all-shares index, meanwhile, dropped by 1.38% or 65.30 points to 4,643.95.

“Stocks were down [yesterday] pulled down by some corporate earnings coming out. We’re the outlier in the region since most markets were up after the inauguration of the new South Korean President,” Victor F. Felix, equity analyst at AB Capital Securities, Inc., said in a phone interview.

“Net foreign buying was sustained so it means foreign funds are coming back so this is local-driven and there’s also some profit-taking after four sessions of gains,” he added.

All counters saw declines yesterday. Holding firms led the losses, dropping 2.35% or 189.21 points to end Wednesday’s session at 7,862.48 followed by industrial which was down 1.63% or 186.61 points to 11,233.44

Financials fell 1.21% or 23.48 points to 1,906.25; property slipped 0.87% or 31.26 points to 3,533.28; services declined 0.75% or 12.48 points to 1,637.31; and, mining and oil fell by 0.27% or 35.38 points to end yesterday’s session at 12,636.33;

Philstocks Financial, Inc. Senior Research Analyst Justino B. Calaycay, Jr. for his part said: “the lift has become a tad heavier as analysts and market begin to tag it a bull market.”

“Now the fundamentals, both of the broad economy and corporate, have a lot of catching up to justify valuations that once more crosses over the 20x trailing earnings. Excitement has been heightened and activity increased and the slope steepened in trades following the Holy Week break,” Mr. Calaycay said in his market note on Wednesday.

“There are two-sides to this recent run-up and subsequent slide: while the former is indeed enticing, it is not to be construed as an all-clear signal as there are still quite a number of risk events in the near term; alternatively, the relative weakness in the last two sessions is not a sign that the preceding run had no legs. It is as it has always been in the market — a 50-50 proposition with the weights shifting in accord with which factor or influence is given preference,” he added.

Mr. Calaycay further said that “except for a handful, (so far) earnings have not been impressive thus unable to elicit enough interest to support the benchmark’s recent three-session, nearly 300-point romp.”

Yesterday saw decliners trumped advancers, 133 to 78, while 35 stocks were unchanged.

Investors traded 2.88 billion issues on Wednesday valued at P10.46 billion, higher than Tuesday’s volume.

Foreign funds bought more shares than they sold.

Analysts put the resistance level at 7,800 to 7,900 with support seen at the 7,600 to 7,700 level.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-retreats-after-briefly-touching-8000-level&id=144955

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion