Top Ten Smart Money Moves – May 18, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 18, 2016 Data)

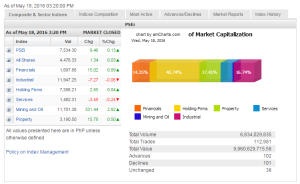

Total Traded Value – PhP 9.961 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 102 Advances vs. 101 Declines = 1.01:1 Neutral

Total Foreign Buying – PhP 5.844 Billion

Total Foreign Selling – Php 5.849 Billion

Net Foreign Buying (Selling) (Php 0.005) Billion – 2nd day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

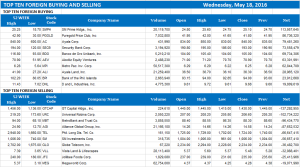

Top Ten Foreign Buying and Selling

and Selling

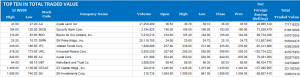

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 18, 2016 07:29:00 PM

By Victor V. Saulon

Index climbs further ahead of PHL growth data

THE PHILIPPINE Stock Exchange index (PSEi) closed slightly higher on Wednesday as the market continued to consolidate ahead of the release of data on the country’s economic performance for the first quarter.

The benchmark index gained 9.46 points or 0.12% to close at 7,534.30, still way above the lows reached during the days leading to the elections. The all-shares index rose by 1.34 points or 0.03% to end at 4,476.33.

“It’s trading within the ranges,” said Lexter L. Azurin, head of research at Unicapital Securities, Inc., about the mart’s performance.

“Since the market has rallied in the past few days, we’re seeing a little bit of profit taking… so basically it’s trying to build a base around these levels,” he added.

He said investors had already priced in the outcome of the elections even as the country’s incoming president Rodrigo R. Duterte came out with more details about his economic plans and new names to man key government offices, which analysts received with mixed sentiments.

“Investors would be focused more on the economic fundamentals of the country as well as whether listed companies are on track to beat their estimates,” he said.

He said he expected a “windfall” for the gross domestic product (GDP) as the quarter was also the run-up period for the May 9 national elections, giving rise to poll-related consumer spending that could boost the local economy.

“Expectations for the first quarter is at least 6.6% [GDP growth]… that’s basically consensus estimate,” Mr. Azurin said.

“If we see better-than-expected first-quarter results, this should definitely give confidence back in the market and it would likely resume its rally,” he said. “If the figure comes out weaker than expected, then we might expect some disappointment.”

Yesterday, local counters closed with mixed results, with those that finished higher registering modest gains.

The mining and oil counter was the biggest gainer at 331.44 or 2.91% to 11,701.38; financials rose by 15.02 points or 0.89% to 1,697.88; property went up 15.78 points or 0.49% to 3,190.50; and holding firms advanced by 2.85 points or 0.03% to 7,586.21.

In contrast, services declined by 3.49 points or 0.23% to 1,482.31 while industrials shed 7.27 points or 0.06% to 11,947.25.

Value turnover was almost flat at P9.96 billion yesterday after 6.83 billion shares changed hands, from the previous day’s P9.97 billion.

Advancers narrowly outnumbered decliners, 102 against 101, while 38 issues were unchanged.

Foreign investors sold more than they bought and finished the session with net sales of P4.96 million worth of stocks, lower than the previous day’s sales of P20.86 million.

Ayala Land, Inc., Security Bank Corp., BDO Unibank, Inc. and Jollibee Foods Corp. were the most active stocks.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=index-climbs-further-ahead-of-phl-growth-data&id=127698

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion