Top Ten Smart Money Moves – May 22, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 22, 2018 Data)

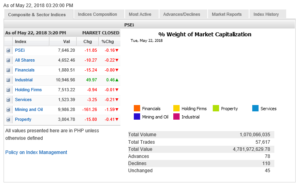

Total Traded Value – PhP 4.782 Billion – Low

Advances Declines – (Ideal is 2:1) 110 Declines vs. 78 Advances = 1.41:1 Neutral

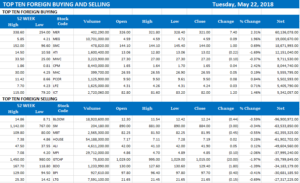

Total Foreign Buying PhP 2.143 Billion

Total Foreign Selling – (PhP 2.771) Billion

Net Foreign Buying (Selling) (PhP 0.628) Billion – 5th day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

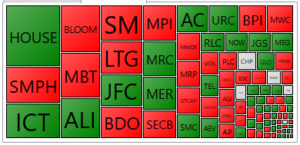

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

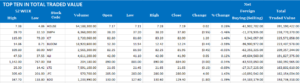

Top Ten in Total Traded Value

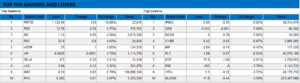

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSE index stays in the red on lack of fresh leads

May 22, 2018 | 9:00 pm

SHARES stayed in negative territory on Tuesday as trading remained slim due to a lack of fresh leads.

The 30-member Philippine Stock Exchange index (PSEi) fell 0.15% or 11.85 points to 7,646.20, remaining in the red for the third consecutive day.

The broader all-shares index also dropped 0.22% or 10.27 points to finish at 4,652.46.

“All important data have been released, and we are at the start of the lean trading months until August. Earnings are just so-so, so I think PSEi will be in a consolidation phase and possible downside over this lean season until ghost month. Investors are looking for catalyst to move forward and they can’t have any at the moment,” IB Gimenez Securities, Inc. Research Head Joylin F. Telagen said via text.

Positive sentiment from Wall Street’s close on Monday also failed to lift the market. The Dow Jones Industrial Average gained 1.21% or 298.20 points to 25,013.29. The S&P 500 index climbed 0.74% or 20.04 points to 2,733.01, while the Nasdaq Composite index firmed up 0.54% or 39.70 points to 7,394.04, as investors welcomed the easing of trade relations between the United States and China.

The US and China have reportedly put threats of tariffs on hold as they deliberate on trade issues.

“Although it was a positive start on Wall Street’s leads in the morning, the PSEi gradually traded lower on account of the Hong Kong market being closed today, and volumes remaining tepid, limiting any advance,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said in a mobile phone message.

Meanwhile, Asian counterparts ended mixed on Tuesday affected by rising oil prices and developments on trade relations.

Most Southeast Asian stock markets were subdued on Tuesday, hurt by a strong dollar that crimped demand for emerging market assets, while Indonesia held firm, gaining over 1%.

The dollar hovered near five-month highs against a basket of currencies, boosted by a respite in US-China trade tensions.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose a touch, up 0.10%. Indonesian shares, however, snapped three sessions of losses to climb over 1%, with financials and consumer stocks leading.

Back home, industrials was the lone sectoral counter that gained on Tuesday, rising 0.45% or 49.97 points to 10,946.98.

Mining and oil plunged 1.58% or 161.26 points to 9,986.28, while financials shed 0.80% or 15.24 points to 1,880.51. Property slipped 0.41% or 15.80 points to 3,804.78; services edged down 0.21% or 3.25 points lower to 1,523.39; while holding firms ended relatively flat with a 0.01% or 0.94-point decline to 7,513.22.

Turnover was valued at P4.78 billion after some 1.07 billion issues switched hands, slightly up from Monday’s P4.19 billion.

Decliners beat advancers, 110 to 78, while 45 names closed flat.

Foreign investors continued their selling mode, with net outflows amounting to P628.52 million, higher than the previous session’s P568.47 million. — Arra B. Francia with Reuters

Source: http://bworldonline.com/pse-index-stays-in-the-red-on-lack-of-fresh-leads/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.