Top Ten Smart Money Moves – May 26, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 26, 2016 Data)

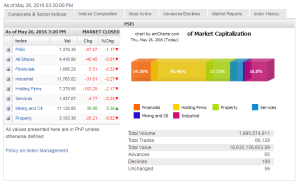

Total Traded Value – PhP 18.635 Billion – High

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 109 Declines vs. 65 Advances = 1.68:1 Neutral

Total Foreign Buying – PhP 12.502 Billion

Total Foreign Selling – (Php 4.087) Billion

Net Foreign Buying (Selling) Php 8.415 Billion – 2nd day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

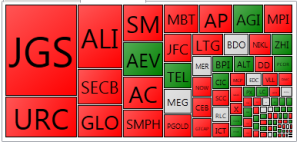

PSE Heat Map

Screenshot courtesy of: PSEGET Software

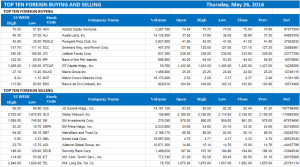

Top Ten Foreign Buying and Selling

and Selling

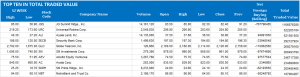

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 26, 2016 08:21:00 PM

Consolidation ends main index’s winning streak

LOCAL STOCKS on Wednesday failed to sustain their surge, faltering in a week that many analysts believed would see the index just moving sideways in the absence of any trigger from foreign markets.

The Philippine Stock Exchange index (PSEi) shed 87.57 points or 1.17% to close at 7,376.38, while the broader all-shares index lost 40.45 points or 0.90% to end the session at 4,416.86.

“It’s going through a medium-term consolidation stage based on what is transpiring in the local scene,” said Harry G. Liu, president of Summit Securities, Inc.

Except for mining and oil, which rose by 39.86 points or 0.36% to 11,126.80, all counters finished lower yesterday, with holding firms registering the biggest decline at 163.29 points or 2.16% to 7,378.90.

Mr. Liu said the decline of the main index was mainly due to profit taking “because we went on an index-high so there’s a slight correction going on.”

Foreign investors bought more shares than they sold, resulting in a net foreign buying of P8.42 billion worth of shares. This was higher than the P890.96 million in net buying seen the day prior.

Value turnover shot up to P18.64 billion, significantly higher than the other day’s P7.66 billion. More than 1.90 billion shares changed hands, an improvement over 1.54 billion previously.

But decliners outnumbered advancers, 109 to 65, while 56 shares were unchanged.

Mr. Liu said the improvement in the stock price of Philippine Long Distance Telephone Co. (PLDT) was not enough to carry the whole market forward.

Shares in PLDT gained P7 or 0.42% to P1,662 after an extended fall following a disappointing earnings report.

Investors are looking at the political arena as Cabinet positions continue to be filled, giving a hint on how the structure of the incoming administration would shape out, he said.

On global markets, he said nothing remarkable happened yesterday, as the US market was up and economic numbers were good. “Both global and our local markets are just going through a sideways behavior,” he said. “Foreign buyers are just watching as to how we progress towards the new administration.”

With the market’s sideways behavior, he said the index should not break below 6,800 and above 7,500. He said what could trigger a break from the “sideways behavior” would be “the final picture where people will see exactly what is going to be in place for the new administration.”

The benchmark PSEi led losses in the region yesterday as it snapped a three-session rising streak, heading towards its worst intraday performance since last Friday.

“The decline in the Philippine market is a normal technical move — rising oil prices may be a reason for some people to take some profit, but this is a market correction more than anything else,” said Joseph Roxas, an analyst at brokerage firm Eagle Equities. — Victor V. Saulon, with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=consolidation-ends-main-index&8217s-winning-streak&id=128028

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion