Top Ten Smart Money Moves – May 26, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today (Based on May 26, 2017 Data)

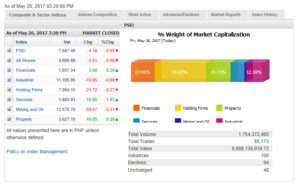

Total Traded Value – PhP 8.088 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 100 Advances vs. 94 Declines = 1.06:1 Neutral

Total Foreign Buying – PhP 4.050 Billion

Total Foreign Selling – (PhP 4.153) Billion

Net Foreign Buying (Selling) – (PhP 0.109 Billion) 1st day of Net Foreign Selling after 4 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

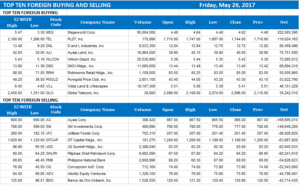

Top Ten Foreign Buying and Selling

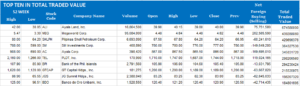

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi to climb further as sentiment stays positive

Posted on May 29, 2017

THE MARKET is expected to trek higher this week on the back of sustained confidence on the country’s good fundamentals, with short-term worries failing to dent investor optimism.

After a five-day winning streak, the Philippine Stock Exchange index (PSEi) took a breather on Friday, dropping by 4.16 points or 0.05% from Thursday’s finish to end the week at 7,867.49 as investors locked in gains amid lack of leads.

Despite Friday’s decline, however, the bellwether index gained 1.3% for the week from its 7,767.62 close last May 19.

The broader all-shares index also ended the week higher at 4,689.88 from May 19’s finish of 4,634.25.

“Market outlook would continue to be positive especially with the package trade deals made with Russia and as long as the conflict in Mindanao is properly handled,” Aniceto K. Pangan, equities trader at Diversified Securities, Inc., said via text.

He noted that the influx of funds last week is an indication of foreign investors’ confidence in the local market.

“[T]he planned increase in public float requirement for listed companies by SEC (Securities and Exchange Commission) is an added boost to attract more investors, foreign and local, to participate in our market. All these together with the increase in business confidence for [the second quarter], we may see the market continue to propel upward,” Mr. Pangan added.

SEC Chairperson Teresita J. Herbosa said last week that the corporate regulator will soon require listed companies, as well as firms wanting to join the local bourse, to sell at least 15% of their issued and outstanding common shares to the public, compared to the current minimum float of 10%.

“Market will try to be a little bit upbeat upward this week. Everything has been talked about related to current local concerns and the support for the President remains high. Investors are also focusing on the good economic condition of the country as it is believed that the situation in Mindanao is already being handled by the government,” Summit Securities, Inc. President Harry G. Liu said in a phone interview.

“On the Martial Law worries, the more crucial issue for investors is when it is extended to Luzon. That would be a main concern,” Mr. Liu said.

Mr. Liu said Eagle Cement Corp.’s debut on the local bourse today will set the tone for the week. He pegged the PSEi’s support at around 7,650-7,700 range and resistance at 7,800-8,000.

Justino B. Calaycay, Jr., senior research analyst at Philstocks Financial, Inc., said last week’s performance reflects a “positively biased” sentiment in the market.

This week, he said investors will start positioning ahead of the US Federal Reserve’s regular economic assessment and rate setting meeting in mid-June, “with bets on a tweak still ahead of a stay.”

Mr. Calaycay expects the PSEi to test the 7,900-8,000 band this week as sentiment continues to be positive. — Imee Charlee C. Delavin

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-to-climb-further-as-sentiment-stays-positive&id=145890

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion