Top Ten Smart Money Moves – May 4, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 4, 2018 Data)

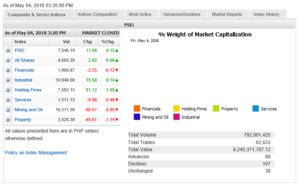

Total Traded Value – PhP 6.245 Billion – Low

Advances Declines – (Ideal is 2:1) 107 Declines vs. 88 Advances = 1.22:1 Neutral

Total Foreign Buying PhP 3.755 Billion

Total Foreign Selling – (PhP 3.223) Billion

Net Foreign Buying (Selling) PhP 0.532 Billion – first day of Net Foreign Buying after 10 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

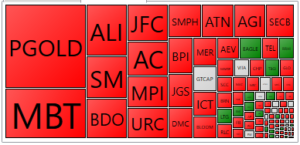

PSE HEAT MAP

Screenshot courtesy of PSEGET

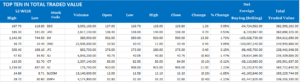

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

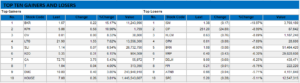

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Shares to decline amid weak investor sentiment

May 7, 2018 | 12:01 am

By Arra B. Francia

Reporter

LOCAL EQUITIES may continue to fall this week, as higher oil prices and faster inflation, among others, drag down investor sentiment.

The Philippine Stock Exchange index (PSEi) mounted a last-minute recovery on Friday, adding 0.14% or 11.09 points to close at 7,546.19. This allowed the market to recover from its lowest close in a year last Thursday, when it tumbled to 7,535.10, versus April 19, 2017’s 7,522.98 finish.

Week on week, the index dropped 2.26% or 174.83 points, weighed down by property which closed 2.6% lower; holding firms that slipped 1.3%; and financials that shed 2%.

“The consecutive three days of gains that we saw last week have proven to be a dead cat bounce, as it quickly reversed after testing the 7,800 resistance level. This did not come as a surprise as we expected the index to test the support level at 7,500,” Eagle Equities, Inc. Research Head Christopher John Mangun said in a market report.

This week, Mr. Mangun noted that the PSEi could fall even further, potentially breaking the 7,500 support level.

“Based on market sentiment we will continue to see this market go lower… Investors are still worried about the different economic factors. Oil prices continue to rise which will push inflation higher. The Philippine peso has been another concern, it has stabilized at the P51.60 area after constantly testing its resistance at P52.40,” he said.

The analyst said for the PSEi to recover, trading volume would have to pick up first. Value turnover last week was down by 12% to an average of P5.3 billion per day.

Online brokerage 2TradeAsia.com, meanwhile, said that investors will turn to the Bangko Sentral ng Pilipinas’ policy review on May 10. This is after the United States Federal Open Market Committee decided to keep interest rates steady during its meeting last May 2.

“Markets have been anticipating for a possible 25-basis point hike, which we view as more responsive to control inflation and prevent further capital flight. Listed firms are also more aptly prepared, with majority of debt negotiated on fixed rate term,” 2TradeAsia.com said in a market note.

Investors will also be seeking clarity on the latest executive order on contractualization as well as details on the second package on the Tax Reform for Acceleration and Inclusion law, according to 2TradeAsia.com.

Several firms are due to report their first-quarter earnings this week. This includes PLDT, Inc., Globe Telecom, Inc., Energy Development Corp., First Gen Corp., Petron Corp., Manila Water Co., Inc., Ayala Land, Inc., Robinsons Land Corp., Ayala Corp., San Miguel Corp., and San Miguel Food and Beverage, Inc.

With this, 2TradeAsia.com cautioned against volatility in the market. The online brokerage placed the market’s immediate support at 7,400, while resistance may play between 7,600 to 7,700.

Source: http://bworldonline.com/shares-to-decline-amid-weak-investor-sentiment/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.