Top Ten Smart Money Moves – May 6, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

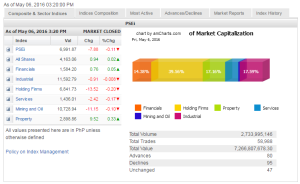

Trading Notes for Today – (Based on May 6, 2016 Data)

Total Traded Value – PhP 7.267 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 95 Declines vs. 80 Advances = 1.19:1 Neutral

Total Foreign Buying – PhP 4.761 Billion

Total Foreign Selling – (Php 5.372) Billion

Net Foreign Buying (Selling) (Php 0.611) Billion – 2nd day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

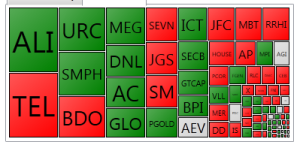

PSE Heat Map

Screenshot courtesy of: PSEGET Software

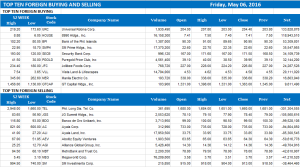

Top Ten Foreign Buying and Selling

and Selling

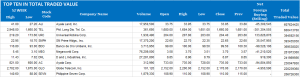

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 09, 2016 06:46:00 PM

By Victor V. Saulon

Cautious trading seen ahead of election results

INVESTORS will be taking a wait-and-see stance this week as they assess the market’s response to the elections ahead of the official results expected in the coming days, analysts said.

“For now, the investing community will be on a wait-and-see mode to check on the market’s quick acceptance of results, which might still be marred by possible protests from candidates inclined to question the counting process,” 2TradeAsia.com’s research team said in its May 9-13 outlook.

On Monday, voters cast their votes to elect the country’s 16th president. Several weeks leading to the polls, Davao City Mayor Rodrigo R. Duterte topped various surveys on a campaign that banked on his image as a crime- and graft-busting leader. But a meeting with the country’s main business groups left unanswered questions on his economic plans.

2TradeAsia.com said earlier reports indicate that the final election tally might be released on May 25, “pending possible move from Congress to conduct manual ballot counting. “

Luis A. Limlingan, business development head at Regina Capital Development Corp., said if the index would not recover above its 200-day moving average of 7,035, prices might continue moving in a “sideways to down” manner.

He said volatility was again becoming a concern as the 14-day average true range increased by 13.27% after it slipped at 62.99 points on April 29.

“This suggests that we should be prepared for choppier intraday movements but with downward bias due to bearish weekly technicals. Right now, we’re setting key support at 6,900 — failure to hold this will result to extended pullbacks to 6,850,” he said.

On the positive side, he said the index’s near oversold readings could trigger a rebound “but we advise traders to use this to lighten up positions.”

“Based on intraday volatility, daily range for the week is set between 6,900 to 7,100,” he said.

Last week, the Philippine Stock Exchange index shed 167.42 points or 2.34% to close at 6,991.87 week on week. It last finished below 7,000 on Oct. 24, when it hit 6,924.77.

Beyond the final election tally, investors are also looking at how the country’s new leadership will be carrying the country forward in terms of economic policy.

“Sans political personalities, markets are watching for decisive economic platform from the new administration, to ensure political noises will be kept to a minimum,” 2TradeAsia.com said in its outlook.

It said the country was facing a major crossroad with the election of its chief executive officer. It added that the international community would be watching as aspects concerning foreign investment, international trade, bilateral relations and geopolitical stance are implemented within the new leader’s stewardship.

“Trade cautiously. Immediate support is 6,900, secondary at 6,800, resistance 7,050-7,100,” it said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=cautious-trading-seen-ahead-of-election-results&id=127211

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion