Top Ten Smart Money Moves – November 15, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on November 15, 2016 Data)

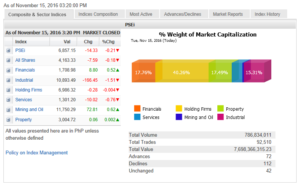

Total Traded Value – PhP 7.698 Billion – Low

Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 112 Declines vs. 72 Advances = 1.56:1 Neutral

Total Foreign Buying – PhP 3.509 Billion

Total Foreign Selling – (PhP 4.873 Billion)

Net Foreign Buying (Selling) – (PhP 1.328 Billion) – 5th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

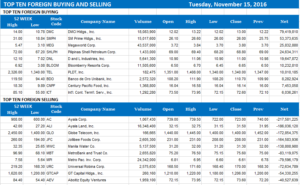

Top Ten Foreign Buying and Selling

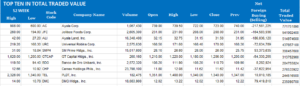

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PHL stocks extend slump as investors exit market

Posted on November 16, 2016

THE LOCAL MARKET continued its downtrend yesterday on bargain hunting and as foreign selling persisted, putting the benchmark index deeper in the red for the year.

The benchmark Philippine Stock Exchange index (PSEi) gave up 14.33 points or 0.2% to close trading at 6,857.15 on Tuesday from 6,871.48 on Monday. The bellwether index is now almost a hundred points lower than its end-2015 close of 6,952.08.

The broader all shares index also declined 7.59 points or 0.18% to end at 4,163.33 yesterday from Monday’s 4,170.92.

“We saw a technical rebound in the morning and some buying relief but in the afternoon session, stocks dipped due to strong selling pressure from foreign investors which local investors were not able to support,”Luis A. Limlingan, business development head at Regina Capital Development Corp., said in a telephone interview on Tuesday.

“The decline was really mainly due to net foreign selling…which I guess is due to the increased likelihood of rate hike next month. So there’s positioning ahead of the aggressive fiscal expansion in the US in line with the Trump administration,” he added.

Locally, Mr. Limlingan said the weak third-quarter earnings results of big companies also dragged the main index down.

Lexter A. Azurin, head of research at Unicapital Securities, Inc., said trading yesterday was mainly “earnings driven.”

“We saw bargain hunting in the market which was dictated by third quarter results, where we are getting mixed results from major companies. It’s mainly earnings driven. Investors continue to reassess their portfolio on companies that have reported weak results,” he said.

Foreigners continued to dump their shareholdings with net sales reaching P1.33 billion yesterday, albeit lower than Monday’s net outflow worth P1.69 billion.

Sectoral sub-indices were mixed yesterday. Industrials led those in the red with a 166.45-point or 1.5% decline to 10,893.49; services was down 10.02 points or 0.76% to 1,301.20; while holding firms lost less than a point to end at 6,986.32.

On the other hand, financials gained 8.80 points or 0.51% to close at 1,708.98; mining and oil was up 72.81 points or 0.62% to 11,750.29; and property saw an uptick of 0.06 point to 3,004.72.

Value turnover went up to P7.698 billion yesterday from Monday’s P7.34 billion after 786.834 million shares changed hands. Decliners beat advancers, 112 to 72, while 42 issues were unchanged.

For today, Mr. Azurin said the PSEi could trade at the 6,750-6,850 level and investors may continue to flee to safer havens amid continued uncertainty.

Regina Capital’s Mr. Limlingan, for his part, said net foreign selling may continue with the PSEi seen to move within 6,800-7,000.

“It seems like we haven’t seen the market bottom out yet and we might continue to see net foreign selling persist the next few days,” he added. — Imee Charlee C. Delavin

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=phl-stocks-extend-slump-as-investors-exit-market&id=136407

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion