Top Ten Smart Money Moves – November 21, 2019

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

================================

As promised in my last post, Back from the Hack, we are resuming all our activities both in our website and Facebook starting August 1, 2019.

This section of our website has been running for the past five years. Perhaps you are asking, why Top Ten Smart Money Moves? This is what I have written in my new book: “Swing Trading with TRT – A Definitive Guide for Swing Trading the Philippine Stock Market.”

“SMART MONEY

The PSE achieved a milestone by the end of the year 2018 when they reported that the number of stock market accounts broke past the one million mark as a result of the substantial increase in online accounts.

Retail investors owned most of the stock market accounts, representing 97.5% of the total accounts while the remaining 2.5% is held by the institutional investors also considered as smart money.

While we, the retail traders, are big in number, we are small in terms of influence in the stock market because more than 50% of the Total Traded Value Daily is accounted for the institutional investors whose transactions are focused mostly on a handful of their selected stocks.

In our Website, we have a regular feature “Top Ten Smart Money Moves” where we monitor the Top Ten stocks being bought and sold by the smart money.

========================================================

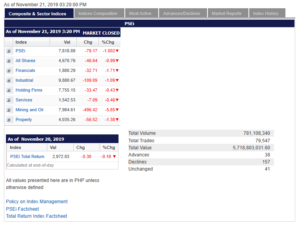

Trading Notes for Today – (Based on November 21, 2019 Data)

Total Traded Value – PhP 5.719 Billion – Low

Advances Declines – (Ideal is 2:1) 38 Advances vs. 157 Declines = 4.13:1 Bearish

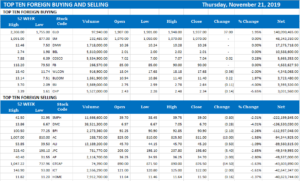

Total Foreign Buying PhP 2.588 Billion

Total Foreign Selling – (PhP 3.592) Billion

Net Foreign Buying (Selling) – (PhP 1.004) Billion – 3rd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

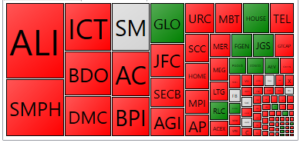

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

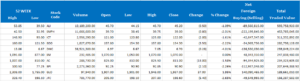

Top Ten in Total Traded Value

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Shares decline on concerns over US-China deal

November 21, 2019 | 9:00 pm

By Denise A. Valdez, Reporter

LOCAL SHARES dropped on Thursday due to drawbacks in the US-China trade talks, which stoked fears of the lack of an agreement by yearend.

The benchmark Philippine Stock Exchange index (PSEi) erased 79.17 points or 1% to close at 7,818.89 on Thursday, as the broader all-shares index lost 46.64 points or 0.98% to 4,670.76.

“Philippine stocks ended in the red after a report that a trade deal might not be completed this year and after China condemned a US Senate resolution supporting human rights in Hong Kong,” Luis A. Limlingan, head of sales at Regina Capital Development Corp., said in a mobile message yesterday.

Reuters reported on Thursday that the “phase one” US-China trade deal, which has been in the works since last month, may not see its signing within 2019, citing trade experts and people close to the White House.

The report said Beijing’s request to further reduce tariffs on Chinese products and America’s retaliatory demands are getting in the way of the negotiations. It quoted US President Donald Trump as saying he thinks China is “(not) stepping up to the level that (he wants),” which casts greater doubt on the progress of the talks.

Adding another layer to the tension is the US Congress’ passage of a human rights bill aiming to protect Hong Kong nationals. Reuters reported China is dismayed with the development as it had previously asked the measure to not be passed.

AAA Southeast Equities, Inc. Research Head Christopher John Mangun referred to the same reason for the market’s decline on Thursday, saying in an e-mail: “Investors view the recent developments as a major setback to the “phase one” deal that should have been signed by now.”

Amid the global developments, Wall Street ended Wednesday’s trading on red territory: the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite indices fell 0.40%, 0.38% and 0.51%, respectively.

Back home, all sectoral indices went down: mining and oil by 496.42 points or 5.85% to 7,984.61; financials by 32.71 points or 1.71% to 1,880.29; property by 56.52 points or 1.38% to 4,035.26; industrials by 109.09 points or 1.09% to 9,880.67; services by 7.09 points or 0.45% to 1,542.53; and holding firms by 33.47 points or 0.43% to 7,755.15.

Value turnover climbed to P5.72 billion from P4.13 billion on Wednesday, as 781.11 million issues switched hands.

Stocks that lost outnumbered those that gained, 157 against 38, while 41 names were unchanged at Thursday’s close.

Foreign outflows increased on Thursday with net selling reaching P1 billion from Wednesday’s P655.08 million.

“The pickup in foreign outflows coupled with low volumes took a toll on the index… We may see a minor bounce in tomorrow’s trading but it is almost guaranteed that it will end in the red for the week,” Mr. Mangun said on Thursday. — with Reuters

Source: https://www.bworldonline.com/shares-decline-on-concerns-over-us-china-deal/

=====================================================

In line with our VISION, A RESPONSIBLE TRADER IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. We have successfully launched “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” last September 2, 2019. This book is the second in our Responsible Trader Education Series.

You can download Chapter 1 and see the Table of Contents here: https://drive.google.com/file/d/1NZEABnQMiQ_zenEMs0lPFWweX4WBxBHg/view?usp=sharing

The first book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” provided all the basic knowledge that a trader needs to know in order to trade the Philippine Stock Market effectively and efficiently. The first book is about the basics. This second book is about the specifics.

2. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

3. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

4. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

5. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.