Top Ten Smart Money Moves – November 24, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on November 24, 2016 Data)

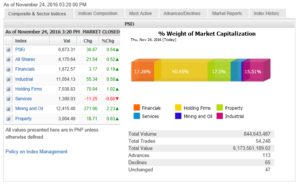

Total Traded Value – PhP 6.174 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 113 Advances vs. 65 Declines = 1.74:1 Neutral

Total Foreign Buying – PhP 2.803 Billion

Total Foreign Selling – (PhP 3.751 Billion)

Net Foreign Buying (Selling) – (PhP 0.948) Billion – 5th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

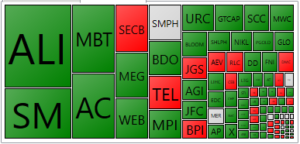

PSE HEAT MAP

Screenshot courtesy of PSEGET

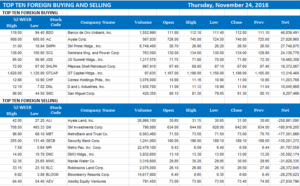

Top Ten Foreign Buying and Selling

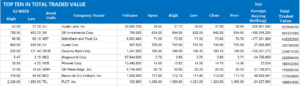

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSE index extends gains amid bargain hunting

Posted on November 25, 2016

THE MARKET rallied for a second consecutive session yesterday as investors continued to pick up bargains following last week’s sell-off.

The Philippine Stock Exchange index (PSEi) gained 36.67 points or 0.54% to end Thursday’s trading at 6,873.31, still down from its end-2015 close of 6,952.08.

The broader all-shares likewise advanced by 21.54 points or 0.52% to 4,170.64.

“The market was up still on bargain hunting and rebalancing of portfolio, so the rise [yesterday] was just technical after we were hardly hit last week,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said via phone yesterday.

“Investors are also trying to interpret the latest minutes of the FOMC (Federal Open Market Committee) meeting on the magnitude of the rate hike which is widely-anticipated next month,” he added.

Summit Securities, Inc. President Harry G. Liu for his part said local stocks ended in the green as a “technical reaction as the market was oversold.”

“We’re still on the consolidation mode due to the downside that happened. Foreign selling continued due to lack of foreign participation and peso weakness and also due to Fed rate hike concerns,” Mr. Liu added.

All counters saw gains yesterday except services which declined by 11.25 points or 0.86% to close at 1,300.03 yesterday. Mining and oil stocks led the gains with 271.06 points or 2.23% to 12,415.40. Holding firms meanwhile, climbed by 70.84 points or 1.02% to 7,038.83; property by 18.71 points or 0.63% to 3,004.49; industrial by 55.34 points or 0.50% to 11,054.13; and financials by 3.17 points or 0.19% to 1,672.57.

The market witnessed 113 stocks advance versus the 65 that declined and 47 that remained unchanged. Value turnover however fell to P6.17 billion, after 844.64 million issues changed hands, from the P6.67 billion recorded on Wednesday.

Foreign investors continued to dump shares, with net selling reaching P948.30 million, although lesser than the P1.07 billion seen the day prior.

Diversified Securities, Inc. equities trader Aniceto K. Pangan shared the same sentiment that the market rebound was due to bargain-hunting.

“We had a market that’s oversold two days ago, I believe foreign investors are on net selling mode because of the uncertainty brought up by the President-elect in the United States which has a protectionist stand.”

“Most uncertainties are sipping through the market, particularly the incoming rate hike in December which makes the dollar stronger,” Mr. Liu said over phone.

For today, analysts said the sell-off may persist as domestic and global worries nag. Mr. Limlingan said the PSEi will likely move within the 6,650-7,000 range, while Mr. Liu pegged the support level at 6,800 and the resistance at 6,970. — Imee Charlee C. Delavin

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-extends-gains-amid-bargain-hunting&id=136865

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion