Top Ten Smart Money Moves – November 4, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on November 4, 2016 Data)

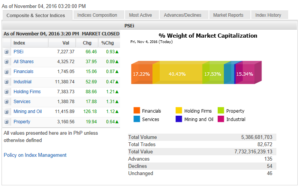

Total Traded Value – PhP 7.732 Billion – Low

Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 135 Advances vs. 54 Declines = 2.50:1 Bullish

Total Foreign Buying – PhP 3.885 Billion

Total Foreign Selling – (PhP 4.907) Billion

Net Foreign Buying (Selling) –(PhP 1.022 Billion) – 8th day of Net Foreign Selling after 3 days Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

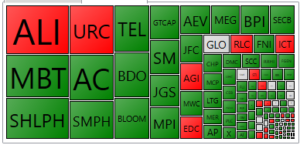

PSE HEAT MAP

Screenshot courtesy of PSEGET

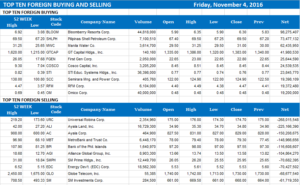

Top Ten Foreign Buying and Selling

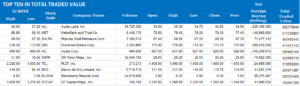

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Lackluster trade seen with US election in focus

Posted on November 07, 2016

THE STOCK MARKET may see sustained lackluster trading this week due to jitters ahead of the upcoming US presidential election and as local earnings reports continue to trickle in.

The Philippine Stock Exchange index (PSEi) ended last week in positive territory after days of decline, rising 66.46 points or 0.92% to close at 7,227.37 on Friday, while the broader all-shares climbed 37.95 points or 0.88% to 4,325.72.

Analysts saw Friday’s rise as a technical bounce.

But even after rebounding, the PSEi’s finish last week was still lower than its 7,404.80 close last Oct. 28.

This week, the bellwether index could hover within the 7,000 and 7,400 levels, with overseas catalysts seen as drivers.

The market is closely watching the Nov. 8 US elections which will see either Hillary Clinton or Donald Trump succeed incumbent President Barack Obama.

“We expect the PSEi to track international markets again due to the lack of significant local catalysts, with the US elections taking center stage. We expect the PSEi to trade between 7,150 and 7,350,” BPI Asset Management said in its weekly outlook.

A&A Securities, Inc.’s Head of Market and Research Justino B. Calaycay, Jr. said it may be another “challenging” week for the local bourse.

“Investors will return to a full week of trades from a position of weakness — despite Friday’s rebound which could just be a dead-cat given the nine-session slump that preceded it… The overcast skies will continue to loom over the markets ahead of the US elections which has once again become too close to call. The drop in oil prices as prospects of an OPEC (Organization of the Petroleum Exporting Countries) production cap fade is hurting energy firms while US corporate earnings are mixed,” Mr. Calaycay said in a weekly market note.

“It may well be another challenging week ahead for the local bourse with investors trying to strike a balance between fundamentals and the unfolding events that threaten to derail it,” he added.

Mr. Calaycay also noted that “an expected slew of earnings data could provide the needed impetus to favor the bulls.”

Luis A. Limlingan, business development head at Regina Capital Development Corp., said in a text message: “We expect the PSEi to carry a lot of volatility this week, with trend bias still on the bearish side.”

Mr. Limlingan said that in case the rally is sustained, the maximum upside of the PSEi would be its 200-day moving average of 7,404.

“On the other hand, the PSEi could extend its losses down to 7,090 which is a 50% retracement from July highs,” he noted.

“However, this is just the first leg of the corrective wave because of a more significant retracement point at 61.8% which is currently at 6,849… For this week we are not particularly bullish on any issues but those trading near/at oversold conditions are candidates for short-term trading,” Mr. Limlingan added. — I.C.C. Delavin

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=lackluster-trade-seen-with-us-election-in-focus&id=135934

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion