Top Ten Smart Money Moves – November 7, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

================================

Trading Notes for Today – (Based on November 7, 2018 Data)

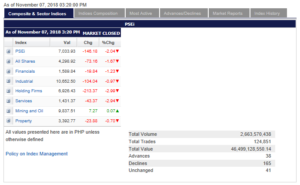

Total Traded Value – PhP 46.499 Billion – High

Advances Declines – (Ideal is 2:1) 165 Declines vs. 38 Advances = 4.34:1 Bearish

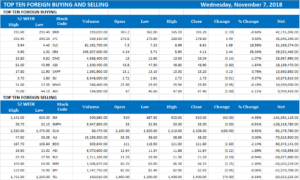

Total Foreign Buying PhP 41.716 Billion

Total Foreign Selling – (PhP 3.121) Billion

Net Foreign Buying (Selling) – PhP 38.595 Billion – 1st day of Net Foreign Buying after 2 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

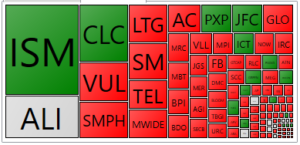

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

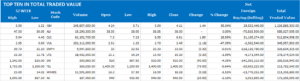

Top Ten in Total Traded Value

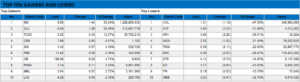

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi down as telcos drop on third player search

November 7, 2018 | 9:00 pm

THE MAIN INDEX plunged on Wednesday after investors sold down listed telco stocks as they anticipated the declaration of the winning third player.

The bellwether Philippine Stock Exchange index (PSEi) spiraled down 2.03% or 146.18 points to close at 7,033.93 yesterday. The broader all-shares index likewise shed 1.67% or 73.16 points to 4,298.92.

“The main index closed lower again today as most investors focused on trading second-liners in anticipation of the third telco bidding documents submission,” Eagle Equities, Inc. Research Head Christopher John Mangun said in an e-mail on Wednesday. “$GLO (Globe Telecom, Inc.) and $TEL (PLDT, Inc.) took major hits today which was to be expected as investors moved to companies that would challenge the current duopoly. This also dragged the main index down.”

Shares in Globe dropped by 8.92% or P188 to P1,920 each yesterday, while PLDT also ended 5.64% or P79 lower to P1,321 apiece.

P2P Trade Online Sales Associate Gabriel Jose F. Perez also noted that the two companies may have been affected by the third telco decision, with Globe recording the third highest foreign outflow figure of P92 million.

ISM Communications, Inc., which could potentially be used for businessman Dennis A. Uy’s third telco bid, was the most actively traded for the day, surging 35.04% to P5.55 each. Chelsea Logistics Holdings, Corp., another Uy-led firm, also jumped 28.59% to P8.50.

Mr. Uy’s consortium with China Telecommunications Corp. emerged as the lone bidder to qualify for the next screening phase for the third telco selection process.

Mr. Perez added that investors may be looking forward to the release of third-quarter gross domestic figures on Thursday. The Department of Finance said on Wednesday that the economy likely grew by 6.5% in the third quarter. Meanwhile, a BusinessWorld poll of 15 analysts resulted in a median forecast of 6.3%.

“Price action for the index suggests that participants could be anticipating disappointing figures [on Thursday],” Mr. Perez said.

Mining and oil was the lone counter that eked out gains, adding 0.07% or 7.27 points to 9,837.51. The rest declined, led by holding firms which dropped 2.98% or 213.37 points to 6,926.43. Services slumped 2.94% or 43.37 points to 1,431.37; financials slipped 1.23% or 19.84 points to 1,589.84; industrials shed 0.96% or 104.04 points to 10,652.50; while property was down by 0.69% or 23.88 points to 3,392.77.

Turnover swelled to P46.50 billion after some 2.66 billion issues switched hands, primarily due to the crossing of shares related to San Miguel Food and Beverage, Inc.’s (SMFB) follow-on offering.

Foreign investors turned buyers, recording net purchases of P38.60 billion compared to the previous session’s P793.47 million net selling due to the block transactions by SMFB. Excluding the transaction, the market recorded a net foreign selling figure of P545 million.

Decliners were about quadruple that of advancers, 165 to 38, while 41 names were unchanged. — Arra B. Francia

Source: https://www.bworldonline.com/psei-down-as-telcos-drop-on-third-player-search/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.