Top Ten Smart Money Moves – November 9, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on November 9, 2016 Data)

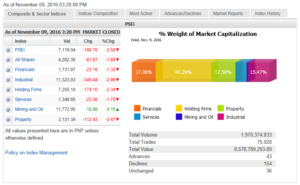

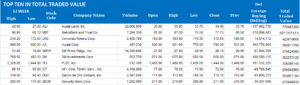

Total Traded Value – PhP 8.579 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 154 Declines vs. 43 Advances = 3.58:1 Bearish

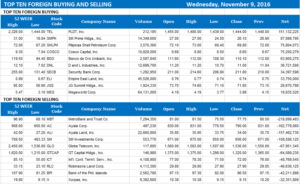

Total Foreign Buying – PhP 3.861 Billion

Total Foreign Selling – (PhP 4.075 Billion)

Net Foreign Buying (Selling) – (PhP 0.214 Billion) – first day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

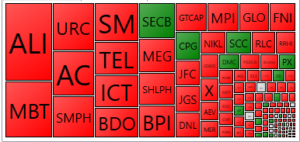

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSE index crashes to 6-month low on Trump win

Posted on November 10, 2016

THE MAIN INDEX resumed its slump yesterday, dropping to its lowest level in six months, as the victory of Republican candidate Donald Trump in the United States’ presidential race caught investors “unprepared”.

The benchmark Philippine Stock Exchange index (PSEi) gave up 188.76 points or 2.58% to 7,119.04 on Wednesday, the local barometer’s lowest level since its May 6 close of 6,991.87 points.

The broader all shares index also dropped 81.87 points or 1.87% to end at 4,282.35.

“Local markets sold off furiously as Republican candidate seems destined for an upset victory as of 3:30 p.m.,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said in a text message yesterday.

The PSEi took its cue from the performances of other Asian bourses as well as the futures market, Mr. Limlingan said. S&P futures slid 5% and hit a limit down, meaning the contract could not trade lower, only sideways or up, in the overnight session into Wednesday. Dow Industrials futures briefly fell 800 points.

“[Mr.] Trump has promised a big change in the corporate sector and huge capital spending via infrastructure, leading to hiring and wage pressure. A massive tax cut is also promised. Foreign policy skill, which is clearly lacking will be a test to the new administration. We can expect immediate flight to safety with gold and US Treasuries bid up,” he added.

Summit Securities, Inc. President Harry G. Liu added that the self-off was driven by “global market concern” over the US election result.

“Investors locally and in the region are a bit concerned over a Trump win causing panic since Trump is not an ordinary politician — he is no different than our own President,” Mr. Liu added, referring to President Rodrigo R. Duterte.

He said “a Trump victory may be good or bad but the market is just skeptical at the moment.”

Only the mining and oil counter ended in the green, rising 18.06 points or 0.15% to 11,772.05.

Meanwhile, the property subindex declined 112.43 points or 3.46% to 3,131.34. Industrial was down by 345.44 points or 2.95% to 11,323.03; holding firms by 174.10 points or 2.34% to 7,255.10; services by 23.36 points or 1.70% to 1,349.65; and financials by 23.19 points or 1.32% to 1,731.97.

Value turnover increased to P8.58 billion after 1.97 billion shares exchanged hands, from Tuesday’s P7.19 billion.

Foreign investors sold stocks anew, with net foreign selling coming in at P213.22 million — a reversal of the net purchases worth P106.11 million seen the previous session.

Decliners also outnumbered advancers, 154 to 43, while 36 issues were unchanged.

For today, analysts said trading will still be driven by developments after Mr. Trump’s win.

“Focus will still be the result of the US election. If the Dow continues to go down, our stocks will also go down…,” Mr. Liu said, with the PSEi’s support level seen between the 7,000-7,100 range. — Imee Charlee C. Delavin

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-crashes-to-6-month-low-on-trump-win&id=136126

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion