Top Ten Smart Money Moves – October 20, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on October 20, 2017 Data)

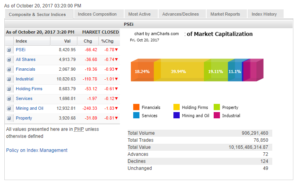

Total Traded Value – PhP 10.165 Billion – Medium

Advances Declines – (Ideal is 2:1) 124 Declines vs. 72 Advances = 1.72:1 Neutral

Total Foreign Buying – PhP 5.264 Billion

Total Foreign Selling – (PhP 7.210) Billion

Net Foreign Buying (Selling) – (PhP 1.946) Billion –3rd day of Net Foreign Selling after 3 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

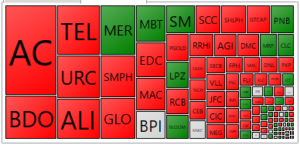

PSE HEAT MAP

Screenshot courtesy of PSEGET

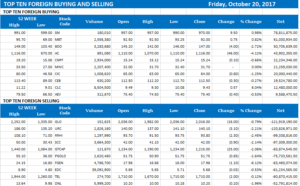

Top Ten Foreign Buying and Selling

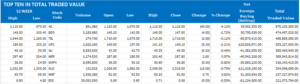

Top Ten in Total Traded Value

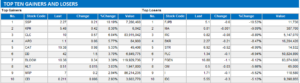

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Analysts see bourse testing 8,500 anew this week

October 23, 2017

THE Philippine Stock Exchange index (PSEi) can lunge at 8,500 anew this week on generally bullish expectations of looming third-quarter earnings reports and as more investors pencil strong economic growth for the same period — scheduled to be reported on Nov. 16 — after news last week quoted Socioeconomic Planning Secretary Ernesto M. Pernia as saying he expects the past three months to have outpaced April-June’s 6.5%, analysts said when asked for their outlook on the days ahead.

The 30-member PSEi finished at its 10th record high for 2017 at 8,497.74 on Oct. 17.

The benchmark index ended last week at a lower 8,420.95 — as profit taking dragged all six sectoral indices into red territory — down a nearly flat 0.319% on the week but still 23.10% higher year to date.

The abbreviated trading week — Monday’s session was cancelled due to a nationwide transport strike — saw PSEi pierce 8,500 for the first time in the middle of trading at 8,586.73 on Oct. 17 — a feat that was replicated the following day that opened at 8,537.66 and peaked at 8,548.58 before pulling back to finish 8,431.73.

“After breaching as much as 8,586 during the week, it is normal to see our gauge pause for breathers to sustain an ascent,” online brokerage 2TradeAsia said in a weekly market note.

“This is warranted, to allow the PSEi to establish firmer ascending channels.”

Philstocks.ph Senior Analyst Justino B. Calaycay, Jr. said leads for the week include third-quarter earnings as well as the looming gross domestic product (GDP) report for the same three months.

“We think it will be an interesting week as bets on a rebound ahead of Q3 earnings and the release of GDP data comes to the trading table,” Mr. Calaycay said in a mobile phone message over the weekend.

2TradeAsia shared this expectation, saying: “The season for 9M17 earnings reporting is on, beginning with MER’s update this week,” referring to Manila Electric Co.’s stock symbol.

“More than quarter-on-quarter comparison, players are likely to give more weight how the last quarter stretch would fare and prospects they could look forward to in 2018.”

At the same time, 2TradeAsia said: “Some players might seize on intraday strength to pocket gains, especially those inclined to react on the on-and-off Fed rate hike prospect [remarks] or other geopolitical events.”

For this week, the online brokerage said, “[m]ovements within 8,400-8,500 should help fortify a new base for the bourse, as fund managers express keen interest in the momentum buildup of government’s infra[structure] projects.”

Support levels this week can play between 8,370 and 8,400, with resistance at 8,500-8,570.

“The slide off the top last week should be inviting to relative bargain hunters even as positions that are still in the green think twice,” Philstocks.ph’s Mr. Calaycay said. “We may see further attempts to settle above 8,500,” — Arra B. Francia

Source: http://bworldonline.com/analysts-see-bourse-testing-8500-anew-week/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book continues to receive positive response and comments from our readers. To reach a wider audience we have made the book available through selected branches of National Bookstore:

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.