Top Ten Smart Money Moves – October 7, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on October 7, 2016 Data)

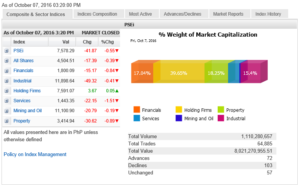

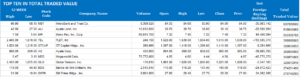

Total Traded Value – PhP 8.021 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 103 Declines vs. 72 Advances = 1.43:1 Neutral

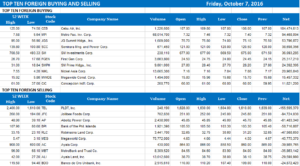

Total Foreign Buying – PhP 4.464 Billion

Total Foreign Selling – (PhP 4.710) Billion

Net Foreign Buying (Selling) – (PhP 0.246) Billion – 3rd day of Net Foreign Selling after 4 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

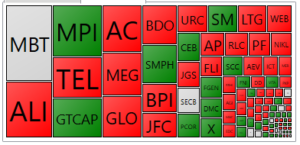

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece: ==================================================

Stocks fall led by telcos as outflows continue

Posted on October 08, 2016

SHARE prices closed lower amid continued foreign fund outflows and sentiment dampened by political noise, with the two main telco stocks leading a decline in index heavyweights, analysts said.

The Philippine Stock Exchange index (PSEi) lost 41.87 points or 0.54% to close at 7,578.29 while the broader all-shares index slid 17.39 points or 0.38% to close at 4,504.51.

Victor F. Felix, an analyst with AB Capital Securities, cited a handful of factors behind the decline on Friday: continued net foreign selling, potential action by the competition regulator in the telecoms industry, as well as political and currency worries.

“A lot of the index heavyweights were down today especially the two telco companies. This was on news that the Solicitor General is now representing the PCC and the claims of the two telco companies,” he said in a phone interview yesterday.

The Philippine Competition Commission is reviewing the deal entered into in May by Globe Telecom, Inc. and PLDT, Inc. to buy the telecommunication assets of San Miguel Corp. (SMC) for P69.1 billion.

Each telco has separately filed for relief with the Court of Appeals, with PLDT, Inc. being granted a temporary restraining order (TRO) on PCC’s planned review of the deal.

The PCC is seeking a motion for reconsideration against the PLDT TRO, wants to comprehensively review the deal to investigate its possible anti-competitive impact.

Globe shares fell the most yesterday, losing P79 or 4.16% to P1,821. PLDT, on the other hand, lost P29 or 1.77% to 1,610.

Meanwhile, Luis A. Limlingan, business development head at Regina Capital Development Corp. attributed the performance of the market to worries over a possible Federal Reserve interest rate hike at the end of the year.

Bloomberg reported that the market is factoring in a 64% probability of a Federal Reserve rate increase this year from 51% at the start of last week.

“It was also down in Asian markets. I think there was a recent survey about a Fed rate hike that increased by 64% and I think everyone is just getting a bit worried. Well, they’re also clamoring for additional easing from the Bank of Japan,” he said in a phone interview yesterday.

All sub-indices were down yesterday apart from holding firms, which rose 3.67 points or 0.04% to close at 7,591.07.

Industrials lost 49.32 points or 0.41% to 11,898.64; Property declined 30.62 points or 0.88% to 3,414.94; services fell 22.15 points or 1.51% to 1,443.35; mining and oil slipped 20.79 points or 0.18% to 11,100.9; while financials lost 15.17 points or 0.83%. to 1,800.09.

Value rose to P8.02 billion yesterday after 1.11 billion shares exchanged hands. There were 103 losers, 72 gainers, while 57 were flat.

Foreign investors maintained a net selling position of P246.06 million, lower than Thursday’s P331.10 million outflow.

Hastings Holdings, Inc., a unit of PLDT Beneficial Trust Fund subsidiary MediaQuest Holdings, Inc., has a stake in BusinessWorld through the Philippine Star Group, which it controls. — Roy Stephen C. Canivel

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-fall-led-by-telcos-as-outflows-continue&id=134543

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion