Top Ten Smart Money Moves – on July 1, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

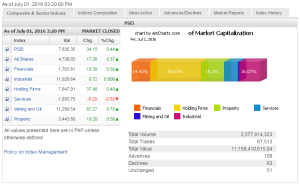

Trading Notes for Today – (Based on July 1, 2016 Data)

Total Traded Value – PhP 11.159 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 100 Advances vs. 83 Declines = 1.20:1 Neutral

Total Foreign Buying – PhP 4.200 Billion

Total Foreign Selling – (Php 2.235) Billion

Net Foreign Buying (Selling) Php 1.965 Billion – 3rd day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

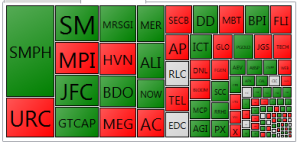

PSE Heat Map

Screenshot courtesy of: PSEGET Software

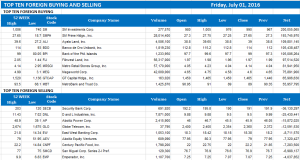

Top Ten Foreign Buying and Selling

and Selling

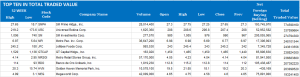

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on July 03, 2016 06:27:00 PM

By Keith Richard D. Mariano, Reporter

Positive sentiment to boost index ahead of data

INVESTORS will consider economic indicators across the globe, including inflation in the Philippines, this week, although confidence in the new administration could continue to support the market’s uptrend toward the 8,000 line, according to analysts.

“The equities market will still likely take cue from relevant economic data releases including the inflation figure for the Philippines and the much-awaited non-farm payrolls data in the United States,” BPI Asset Management said in a weekly review.

The bellwether Philippine Stock Exchange index (PSEi) may trade within the 7,650 to 7,950 range during the week, it added.

Online brokerage 2TradeAsia.com, meanwhile, expects prospects of increased fiscal spending from the government led by newly inaugurated President Rodrigo R. Duterte to positively affect sentiment on the local bourse.

“The boost, however, might likely occur in the fourth quarter, as construction efforts might be delayed with the onset of the rainy season. For now, we maintain our 6.3% [gross domestic product] growth outlook for 2016, with prospective upgrades seen,” 2TradeAsia.com said in a weekly outlook.

In addition, the United Kingdom’s (UK) decision to leave the European Union (EU) is expected to bolster the case for rate cuts from the Bank of England and even other industrialized countries, including the US.

“Market players are already eyeing for this normalization to ensue in October, once [British Prime Minister David] Cameron’s successor undertake the formal process of leaving the EU,” 2TradeAsia.com said.

The online brokerage pegged immediate support for the PSEi at 7,580 to 7,650 and resistance at 7,950 to 8,000 for the week.

“Market uptrend is intact on the high perception that the new administration will execute its plans and the net foreign buying [seen on Friday] at more than P1.9 billion,” Aniceto K. Pangan, trader at Diversified Securities, Inc., noted separately.

Local stocks rallied last week despite the uncertainty arising from the outcome of the UK referendum, as the leadership transition in the Philippines focused attention on the domestic economy’s fundamentals.

The PSEi netted 200.63 points or 2.63% to close at 7,830.35. The main index even reached its highest intraday level for the year at 7,980.75 when Mr. Duterte took office on Thursday.

Value turnover increased to P46.34 billion from P39.74 billion. Foreign investors continued to increase their shareholding in local companies, with net foreign buying rising toP5.89 billion from P4.35 billion.

“In contrast to other Asian markets, the PSEi attracted foreign funds due to the country’s small exposure to both the UK and the EU,” BPI Asset Management said, noting the UK only accounts for 0.9% of Philippine exports and 6% of remittances from overseas Filipino workers.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=positive-sentiment-to-boost-index-ahead-of-data&id=129827

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion