Top Ten Smart Money Moves – September 21, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on September 21, 2016 Data)

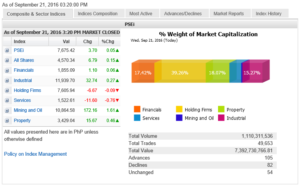

Total Traded Value – PhP 7.393 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 105 Advances vs. 82 Declines = 1.28:1 Neutral

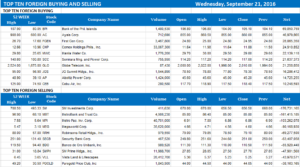

Total Foreign Buying – PhP 4.003 Billion

Total Foreign Selling – (PhP 4.352) Billion

Net Foreign Buying (Selling) (PhP 0.349) Billion – 20th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

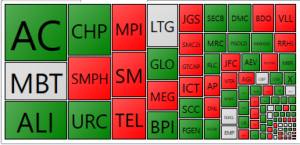

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

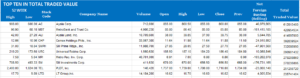

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece: ==================================================

Shares eke out gain after BoJ policy statement

By Keith Richard D. Mariano, Reporter

Posted on September 22, 2016

THE STOCK MARKET managed to wipe out early losses to post a gain on Wednesday, after the Bank of Japan (BoJ) unveiled a modified policy framework to tackle deflation and revive the world’s second largest economy.

The benchmark Philippine Stock Exchange index (PSEi) edged up by 3.70 points or 0.04% upward to 7,675.42 when trading closed. The broader all-shares likewise advanced 6.79 points or 0.14% to 4,570.34.

“Apparently, there was a positive response from the BoJ move, so the main index wiped out the morning losses,” Ralph Christian G. Bodollo, equity research analyst at RCBC Securities, Inc., said in a telephone interview.

Local stocks traded broadly downward earlier in the session, as investors awaited monetary policy announcements from Japan and the United States, Mr. Bodollo noted.

The PSEi opened at 7,686.26 — an intraday high — before stumbling to as low as 7,632.25 within the morning session.

Reuters reported that BoJ decided to adopt a “yield curve control” instead of a base money target under the revamped framework that entails buying long-term government bonds to keep 10-year bond yields at current levels around zero.

“Afternoon session saw Japan stimulate with some bond buying but said it would not drive rates lower. This caused some rally from Asian markets,” Juan G. Barredo, vice-president of sales and customer support at COL Financial Group, Inc., said in a mobile phone message.

Most sectors managed to settle in the green when trading ended on Thursday, with 105 names advancing, 82 declining and 54 remaining steady.

Mining and oil stocks rose by 172.16 points or 1.61% to 10,864.58; property by 15.67 points or 0.45% to 3,429.04; industrial by 32.74 points or 0.27% to 11,939.70; and financials by 1.10 points or 0.05% to end yesterday’s session at 1,855.09.

Services, on the other hand, declined by 11.60 points or 0.75% to 1,522.61. Holdings firms ended 6.67 points or 0.08% lower at 7,605.94 after its rebound during the afternoon session fell short.

Mr. Bodollo, however, noted that many investors opted to stay on the sidelines until the US Federal Reserve announces the outcome of its monetary policy review later on Wednesday.

Value turnover settled below the P8-billion mark although it increased to P7.39 billion, after 1.11 billion issues exchanged hand, from the P6.38 billion recorded on Tuesday.

Net foreign selling also dropped to P348.82 million from P372.53 million

“Markets are volatile ahead of the Fed meeting, but selling pressure this week was abated. I suppose funds don’t want to move in a big way right before the Fed meeting,” Miguel A. Agarao, investment analyst at Wealth Securities, Inc., noted in a mobile phone message.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=shares-eke-out-gain-after-boj-policy-statement&id=133758

==================================================

THANK YOU VERY MUCH FOR YOUR SUPPORT! WE MADE IT TO THE TOP FIVE

Voting for the Angat Pilipinas Coalition for Financial Literacy Polls ended last night and we are glad to inform you that with your support, we were able to make it to the Top 5 in our Category – “Influential Author or the Year.” Apart from the online polls, there will still be judging of the Top 5 nominees for each category with most number of votes. The judges will come from three different independent institutions. We would like to thank you for your Support. Win or Lose, we did our Best and that is the most important thing. More than the votes we received a lot of encouragement and these keep us going in our advocacy: Responsible Trading. Again, from me and The Responsible Trader_com: Maraming salamat po sa inyong walang sawang pagtangkilik at umaasa kami ng mas maganda pang samahan ngayon, bukas at magpakailanman.

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion