Top Ten Smart Money Moves – September 22, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on September 22, 2017 Data)

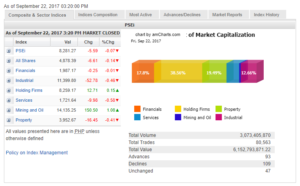

Total Traded Value – PhP 6.153 Billion – Low

Advances Declines – (Ideal is 2:1) 109 Declines vs. 47 Advances = 2.32:1 Bearish

Total Foreign Buying – PhP 2.822 Billion

Total Foreign Selling – (PhP 2.500) Billion

Net Foreign Buying (Selling) – PhP 0.322 Billion – 3rd day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

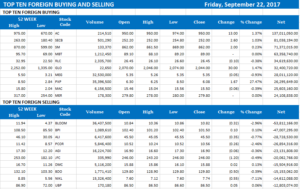

Top Ten Foreign Buying and Selling

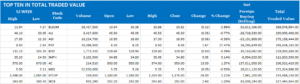

Top Ten in Total Traded Value

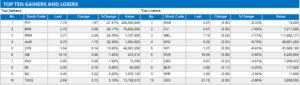

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi seen firm enough to stay above 8,200

September 25, 2017

THE Philippine Stock Exchange index (PSEi) is expected to stand on firm ground above the 8,200 mark this week on a generally stable global interest rate environment and optimism over prospects for tax reform.

“We see the PSEi firming-up above 8,200, as excess liquidity finds its way into equities,” said 2tradeasia.com, the online arm of F. Yap Securities, Inc. “Reverting to our 8,500 target outlook at the start of the year, major inflection point is highly considered, if the latest uptrend is sustained.”

It expects immediate support at 8,200 and resistance at 8,350-8,370.

Last week’s final two sessions saw PSEi breaching the 8,300 mark amid trading before retreating to close below the most recent record-high 8,294.14 finish on Sept. 18.

Harry G. Liu, president of Summit Securities, Inc., said positive developments could easily propel the main index to reach 8,300-8,400.

“I don’t see any long-term crisis that is being anticipated,” Mr. Liu said, adding that “only little problems” could get in the way “but I don’t think it’s something to worry about.”

‘WILD CARD’

Still, 2tradeasia.com has not discounted what it called a “wild card” in the coming days, citing new developments in the continuing geopolitical tension between the US and North Korea.

It cited Pyongyang’s threat to test on an “unprecedented scale” a hydrogen bomb in the Pacific Ocean.

The US has called for fresh economic sanctions against North Korea, targeting its financial and trade transactions.

Overall, worsening geopolitcal tensions could induce appetite in mining- and oil-related stocks, as some players flock to assets otherwise deemed risky.

This week’s expectations come immediately after shares soared to new highs and breach past 8,321.

In part, the rise was fueled by the United States Federal Open Market Committee’s move to maintain monetary policy last week, while signaling the possibility of tightening towards the end of the year.

Locally, the Bangko Sentral ng Pilipinas also kept its policy stance steady, even as it raised its inflation forecast for 2019 after maintaining its 2017 and 2018 outlooks.

Also moving the equities market last week was anticipation of the second tax reform package after the first tranche bagged approval by the Senate ways and means committee, raising the possibility of plenary approval before both houses of Congress adjourn for an Oct. 14-Nov. 12 break. The Executive hopes to implement the first tax reform package in January next year in order to help fund the government’s infrastructure push.

PSEi ended last week at 8,281.27, about 1.23% more than its 8,180.85 finish the week prior.

Last week saw P924.791 million in net foreign buying in the last three trading days offset the first two days’ P317.658 million in net foreign selling. — V. V. Saulon

Source: http://bworldonline.com/psei-seen-firm-enough-stay-8200/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book continues to receive positive response and comments from our readers. To reach a wider audience we have made the book available through selected branches of National Bookstore:

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.