Top Ten Smart Money Moves – September 6, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on September 6, 2018 Data)

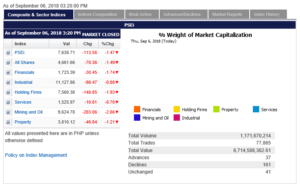

Total Traded Value – PhP 6.714 Billion – Low

Advances Declines – (Ideal is 2:1) 161 Declines vs. 37 Advances = 4.35:1 Bearish

Total Foreign Buying PhP 2.763 Billion

Total Foreign Selling – (PhP 3.780) Billion

Net Foreign Buying (Selling) – (PhP 1.017) Billion – 6th day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

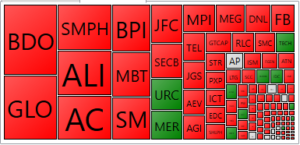

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

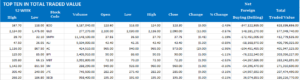

Top Ten in Total Traded Value

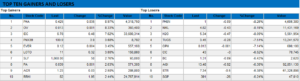

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi drops as investors assess inflation’s impact

THE LOCAL BOURSE tumbled further on Thursday as the faster-than-expected August inflation print continued to roil the market and as global trade tensions further dampened sentiment.

The bellwether Philippine Stock Exchange index (PSEi) plunged 1.46% or 113.56 points to close at 7,638.71 Thursday, September 6.

The broader all-shares index also declined 1.48% or 70.36 points to finish at 4,661.66.

The PSEi dropped by as much as 163 points intraday, hitting a low of 7,552.24. However, last-minute buying activities propped up the benchmark index towards the close.

“Philippine shares continued to be sold with investors still assessing the impact of inflation and whether this would still continue in the succeeding periods,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said in a mobile message on Thursday. “The performance of regional markets did not help either.”

On Wednesday, the Philippine Statistics Authority reported that headline inflation picked up to 6.4% in August — faster than July’s 5.7% and the highest since March 2009’s 6.6%. This was also well beyond government and market estimates.

The August print brought the year-to-date average to 4.8%, exceeding the government’s 2-4% target for the year.

However, economic managers said they expect inflation to taper off towards the end of the year.

Jervin S. de Celis, Timson Securities, Inc. equity trader, said volatility in emerging markets also pulled down the local bourse.

“[T]he rout in emerging markets is stirring worries among investors about the resilience of these countries to Western catalysts,” Mr. De Celis said in a mobile phone message Thursday, September 6.

Mr. De Celis said markets were also cautious ahead of more tariff hikes expected from the United States.

“That’s dragging market sentiments lower among emerging countries as trade wars threaten global growth,” he added.

All sector counters closed in the red again on Thursday.

Mining and oil posted the biggest loss as the sector plunged 2.85% or 283.06 points to 9,624.78. Holding firms slid 1.93% or 148.85 points to 7,560.38; financials gave up 1.73% or 30.45 points to 1,723.39; property edged down 1.21% or 46.84 points to 3,810.12; industrials dropped 0.87% or 98.47 points to 11,127.86; and services dipped 0.7% or 10.81 points to 1,525.97.

Value turnover stood at P6.71 billion yesterday as 1.17 billion shares changed hands, climbing from Wednesday’s P5.89 billion.

Decliners trumped advancers, 161 to 37, while 41 names closed unchanged. Foreigners logged net sales of P1.02 billion, little changed from Wednesday’s P1.04-billion net outflow.

Meanwhile, on Wall Street, the Dow Jones Industrial Average rose 22.51 points or 0.09% to 25,974.99; the S&P 500 lost 8.12 points or 0.28% to 2,888.60; and the Nasdaq Composite dropped 96.07 point or 1.19% to 7,995.17. — J.C. Lim with Reuters

Source: http://www.bworldonline.com/psei-drops-as-investors-assess-inflations-impact/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.