VOH – Victims of Hype – Part 2

VOH – Victims of Hype – Part 2 – The Anatomy of a Hype

First of all, we would like to state that in our first article, we are not alluding to any person or any group in Facebook or otherwise. Part 1 of this article was posted in all groups in Facebook where The Responsible Trader is a member and not just a single one, in the same manner that we post our Top Ten Smart Money Moves every trading day. The article was based on our actual interactions with traders who call themselves VOH – Victims of Hype.

My first encounter with VOH – Victims of Hype occurred during my stint as Teacher/Mentor at Stock Market Pilipinas (stockmarketpilipinas.com) so the subject matter is something that is very familiar to me. I am encountering the same again in Facebook, this time on a larger scale.

We believe in fixing the problem rather than pointing the blame. The first thing to be done to address a problem is to understand it in its entirety. This way we could formulate solutions to minimize if not totally eliminate it.

The Encarta Dictionary defines it as:

| hype [hīp] |

(informal)

noun (plural hypes)

| publicity: greatly exaggerated publicity intended to excite public interest in something such as a movie or theatrical production | |

| somebody or something overpublicized: a widely publicized person or thing | |

| deception: a deception or dishonest scheme |

Source: Microsoft® Encarta® 2009. © 1993-2008 Microsoft Corporation. All rights reserved.

In stock trading, we define HYPE as an exaggerated statement or price projection that is not based in truth or in fact.

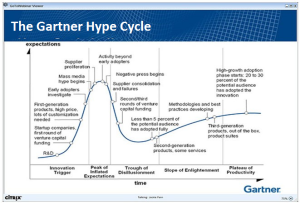

My research has led me to the Gartner Hype Cycle used mostly in technology firms. The same model, to a certain extent, also apply to stocks being hyped in the Philippine stock market.

- Innovation trigger. An event, such as a product launch or product demonstration, creates sudden interest with the press.

- Peak of inflated expectations. Excitement and enthusiasm in the press and among technology leaders causes a bandwagon effect and results in unrealistic expectations.

- Trough of disillusionment. Impatience replaces enthusiasm as it becomes apparent that expectations for performance, adoption, and/or financial returns are not being met. The media now either focuses on unfavorable stories about the technology or abandons the topic altogether.

- Slope of enlightenment. Some businesses soldier on, working out problems, overcoming obstacles, and developing a deep understanding of how to best apply and benefit from the technology.

- Plateau of productivity. Real-world benefits are demonstrated and risks are lowered to acceptable levels. Adoption rates spike as the technology’s value becomes apparent.

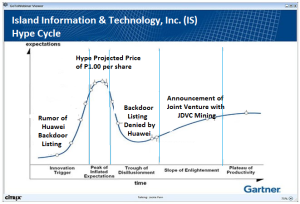

Let us now apply the same model and relate it to one of the stocks that was heavily hyped, Island Information & Technology, Inc. (IS)

- Innovation trigger. Rumor of the company being considered for backdoor listing by Huawei Technologies, Philippines, a leading global ICT solutions provider, started spreading around. Before this, hypers have already accumulated a substantial amount of the stock at lower prices for unloading later on.

- Peak of inflated expectations.Charts and analyses sprouted like mushrooms in social media and Facebook groups. Price projection for the stock to reach P1.00 per share started appearing. The stock became a favorite topic in Facebook, stock trading forums and chatrooms.

- Trough of disillusionment. Huawei Technologies, Philippines, denied any plan for backdoor listing proving that rumors are just based on speculations. Those who bought at the highs are now stuck and do not have a clue what to do next – to hold or to cut losses.

- Slope of enlightenment. To give hope to those who are stuck and prepare for further unloading later on, news of a joint venture with JDVC for mining started appearing. The hope was crushed when the joint venture did not push thru.

- Plateau of productivity. For hyped stocks in the Philippine stock market, this point is never reached. The stock hibernates until some groups start with Stage 1 again.

Based on my observation, the HYPE is usually a prelude to a Pump and Dump Scheme. Whether we like it or not, Hypes and Hypers are here to stay. Hopefully this article has given us a clearer understanding so that we can avoid being a VOH – Victims of Hype in the future.

Coming up Next: Part 3 – Conclusion – From Victims to Victors

Good luck on all your trades.