Top Ten Smart Money Moves – May 2, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 2, 2016 Data)

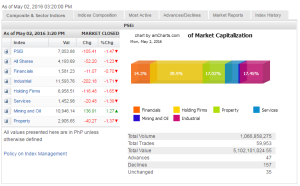

Total Traded Value – PhP 5.102 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 157 Declines vs. 47 Advances = 3.34:1 Bearish

Total Foreign Buying – PhP 1.890 Billion

Total Foreign Selling – (Php 1.916) Billion

Net Foreign Buying (Selling) – (Php 0.026) Billion – 1st day of Net Foreign Selling after 1 day of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

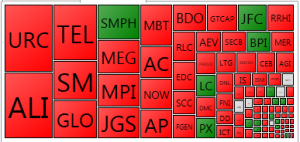

PSE Heat Map

Screenshot courtesy of: PSEGET Software

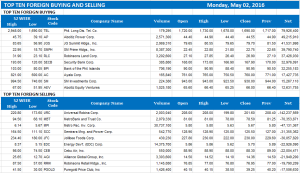

Top Ten Foreign Buying and Selling

and Selling

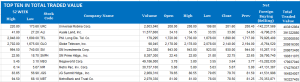

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 02, 2016 06:40:00 PM

By Daphne J. Magturo, Reporter

Poll worries, Japan’s steady policy weigh further

LOCAL STOCKS tracked a region-wide decline to fall for a seventh straight session, as the Bank of Japan’s (BoJ) move to put new stimulus on hold continued to weigh on investors already having pre-election jitters, analysts said.

Q1 corporate earnings to dictate trading aheadTrading ‘quiet’ on poll campaign noiseSigns of recovery surface amid general weaknessSectoral indices retreat ahead of Fed, BoJ remarksWeakness persists as caution rules trading

The Philippine Stock Exchange index (PSEi) plunged by 105.41 points or 1.47% to settle at 7,053.88 at the closing bell, while the broader all-shares index dropped 52.20 points or 1.22% to end at 4,193.69.

“The local market extended its losing streak to a seventh day, opening the pre-election week with triple-digit losses, as investors take cognizance of the heightened risks with the election becoming too close to call and the survey leader unable to present a clear economic program,” Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., said in a report.

“Asian markets are also sustaining losses with the Nikkei losing over 3.0% as the yen strengthened to an 18-month high against the greenback,” he added. “Last week, the BoJ held off adding to the current stimulus program levels as it waits for evidence the negative interest rate in place is making a positive impact.”

Paul Michael A. Angelo, equity analyst at Regina Capital Development Corp., said separately in a mobile phone reply: “We are having a continuation of the region’s downtrend movement due to the Bank of Japan leaving policies unchanged, and is coupled with the current election jitters.”

He noted that the main index could go down to 6,980 on Tuesday “if current prices don’t hold.”

Five out of six domestic sectoral indices bled, with industrials plummeting by 202.18 points or 1.71% to 11,593.76. Holding firms wiped out 116.48 points or 1.64% to 6,958.51; services lost 20.48 points or 1.39% to 1,452.98; property declined by 40.27 points or 1.36% to 2,905.65; and financials dipped by 11.07 points or 0.69% to 1,581.23.

Only the mining and oil subindex gained, surging 136.91 points or 1.26% to 10,946.14.

Monday’s major index losers were DMCI Holdings, Inc.; First Gen Corp.; Megaworld Corp.; Metropolitan Bank & Trust Co. and Universal Robina Corp., according to Mr. Angelo.

Value turnover shrank to P5.10 billion after 1.07 billion shares changed hands, from the P6.08 billion logged in the previous session.

Foreign investors dumped more local shares than they bought, resulting in net foreign selling amounting to P26.49 million that was a reversal from Friday’s net purchases worth P249.36 million.

More than three shares declined for every one that advanced, while 35 names did not move.

“There could be some possible rallies for this week. We believe that this Monday’s market was oversold so chances are some investors might want to buy at dips,” Regina Capital’s Mr. Angelo said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=poll-worries-japan&8217s-steady-policy-weigh-further&id=126863

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion