Top Ten Smart Money Moves – June 13, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 13, 2016 Data)

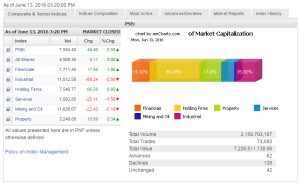

Total Traded Value – PhP 7.220 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 128 Declines vs. 62 Advances = 2.06:1 Bearish

Total Foreign Buying – PhP 3.281 Billion

Total Foreign Selling – (Php 3.711) Billion

Net Foreign Buying (Selling) (Php 0.430) Billion – 2nd day of Net Foreign Selling after 12 days of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

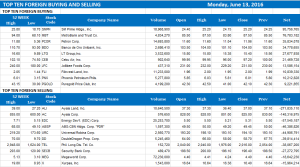

Top Ten Foreign Buying and Selling

and Selling

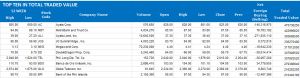

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 13, 2016 07:07:00 PM

Stocks wipe out early losses on bargain hunting

THE LOCAL stock barometer recovered during a mixed trading on Monday, as investors hunted for bargains while remaining cautious of developments abroad.

The Philippine Stock Exchange index (PSEi) gained 44.46 points or 0.59% to close at its intraday high of 7,554.40 yesterday.

The broader all-shares index, meanwhile, rose by 4.11 points or 0.09% to 4,508.36.

The PSEi advanced to 7,510.31 when the market opened. The index, however, retreated and reached its intraday low of 7,407.22 within the first hour of trading.

“Investors’ sentiment was driven by uncertainties in the global economy,” Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said.

The market is eyeing the results of the US Federal Reserve’s policy meeting on June 14-15 and the referendum to determine whether the United Kingdom would stay in the European Union on June 23.

Ms. Telagen further cited the decline of world oil prices back to less than $50 per barrel behind the dampened investor sentiment.

“But investors picked select oversold stocks at the close, which pushed the market to close higher,” the analyst said via text.

Jonathan L. Ravelas, chief market strategist at BDO Unibank, Inc., also attributed the stock market’s performance to bargain hunting activities near the 7,400 level following last week’s fall.

The financials, holding firms and property counters rose by 17.94 points or 1.05% to 1,711.45; by 66.28 points or 0.88% to 7,540.77; and by 10.89 points or 0.33% to 3,249.88, respectively.

Services registered the biggest decline of 25.11 points or 1.56% to 1,582.85. Industrial stocks slid by 68.24 points or 0.58% to 11,512.58, while mining and oil dropped by 22.43 point or 0.19% to 11,638.07.

Value turnover reached P7.22 billion after 2.16 billion exchanged hands, down slightly from Friday’s P7.83 billion.

Losers outnumbered gainers, 128 to 62, while 42 stocks were unchanged. Foreign investors were net sellers for P430.26 million, higher than Friday’s net sales of P378.62 million.

“I think mostly we’re consolidating ahead of the Fed meeting,” Eagle Equities, Inc. President Joseph Y. Roxas said by phone.

Mr. Roxas noted “there’s still slim chance that they could still raise rates” although recent economic data suggest the US central bank would delay further increases in interest rates.

“For the week, it’s still a cautious trading but I’m more optimistic,” IB Gimenez’s Ms. Telagen said, noting the PSEi could retest the 7,700 level should the Fed leave interest rates unchanged while downside risks could pull the index to 7,200.

BDO’s Mr. Ravelas, meanwhile, said: “I view this as a mere rebound and could be limited to 7,600 to 7,650 levels. A break above the 7,700 level is needed to call the bulls back to play. However, a break below the 7,350 level will call for further losses to 7,000 level.” — Keith Richard D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-wipe-out-early-losses-on-bargain-hunting&id=128908

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion