Top Ten Smart Money Moves – October 28, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on October 28, 2016 Data)

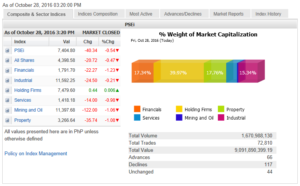

Total Traded Value – PhP 9.092 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 117 Declines vs. 66 Advances = 1.77:1 Neutral

Total Foreign Buying – PhP 4.087 Billion

Total Foreign Selling – (PhP 4.734) Billion

Net Foreign Buying (Selling) –(PhP 0.647 Billion) – 5th day of Net Foreign Selling after 3 days Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

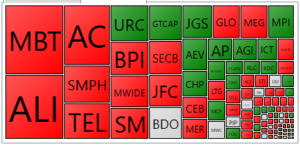

PSE HEAT MAP

Screenshot courtesy of PSEGET

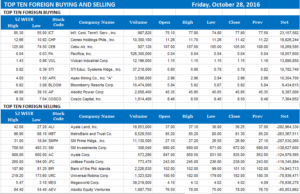

Top Ten Foreign Buying and Selling

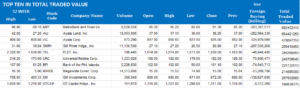

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Weak start seen for market after October slump

Posted on November 02, 2016

THE MARKET may see a weak start to this month as trading resumes today, after concluding October at a lower point compared to the month before in light of various external market concerns.

Analysts expect the Philippine Stock Exchange index to trade within the 7,200 to 7,700 levels in the first week of November, citing international catalysts as the source for momentum for the local bourse.

Investors are on watch this week as the Federal Open Market Committee concludes its two-day meeting today, possibly shedding more light on the chances of a Federal Reserve interest hike at the end of the year.

This, after the main index lost 224.93 points or 2.95% in October as it closed at 7,404.80 last Oct. 28 from its 7629.73 finish last Sept. 30.

“Markets continued to succumb to selling pressure as the index lost another 3% due to net foreign selling and growing uncertainty with the US to election, dampening of oil prices and some early disappointments from Q3 (third quarter) earnings,” said Luis A. Limlingan, business development head at Regina Capital Development Corp., in a text message yesterday.

“In particular toward the end of the month, stocks ultimately lost ground Friday as a fresh FBI (Federal Bureau of Investigation) probe into Democratic presidential candidate Hillary Clinton’s private e-mail server overshadowed news that the US economy grew at its fastest pace in two years.”

“OPEC (Organization of the Petroleum Exporting Countries) and major oil producers failed to secure an agreement in October on plans to implement an output cut in a month’s time Iraq and Iran’s insistence on exemptions emerged as a big sticking point,” Mr. Limlingan added.

Last month, the local market fell for extended periods that offset mostly gains notched.

The local bourse posted consecutive losses on the trading days of Oct. 5-13 as well as on Oct. 20-28.

Last Oct. 13, the stock market saw its largest single-day loss for the month as it fell 117.64 points or 1.58% to 7,312.18.

On the other hand, the market booked its largest daily gain on Oct. 18, rising 212.94 points or 2.89% to close at 7,571.15.

Meanwhile, Southeast Asian stock markets were largely up on Tuesday as a rise in oil prices and growth in Chinese manufacturing activity brought some optimism, but investors continued to exercise caution ahead of next week’s US presidential election.

Oil prices rose from one-month lows after OPEC agreed on a long-term strategy, while China’s manufacturing sector activity grew at the fastest pace in more than two years in October.

The market is also watching the outcome of the US Federal Reserve’s Federal Open Market Committee meeting.

The Bank of Japan held off on expanding stimulus and maintained short-term interest rate target at -0.1%, in line with expectations. — RSCC with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=weak-start-seen-for-market-after-october-slump&id=135742

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion