THE RESPONSIBLE TRADER – EXPERT’S OPINION

THE RESPONSIBLE TRADER – EXPERT’S OPINION

I was browsing through my News Feed when I saw a Screenshot of “Rooting for Celeste”, showing that the words in her Blog have been converted into words that looked like program developer’s scripts indicating that the Blog has either been hacked or has completely gone out of circulation. Please see Figure 1

The name Celeste immediately caught my attention because it rang a bell and brought back memories of my interactions with some Experts in the Trading Community.

ROOTING FOR CELESTE AND FACELESS TRADER

Sometime in November 2015 the blog “Rooting for Celeste” became well known because she discussed sensitive issues about the Philippine stock market to the point of exposing unscrupulous activities of stock market operators. Coming from a lady, this was rather unusual so a lot of traders became intrigued and perhaps out of curiousity got very interested in knowing who she really is.

Jared (Jared Odulio), Nikki (Nikki Yu) and I, are all friends in Facebook and have inter-acted with each other through our posts. I have met Nikki personally because of our dealings in BooKAKA and her participation in a survey about Trading Systems which I have incorporated in my first book “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market.”

I was surprised then when on February 3, 2016, I saw Jared’s post in my News Feed that he had deciphered the true identity of Celeste by comparing the letters of Celeste’s name with that of the Faceless Trader. As can be seen in the picture, he arrived at his conclusion by putting the letters of both names one on top of each other. As his post read: I’m not a TIRADOR for Nothing. Please see Figure 2.

Source: Facebook, Jared Odulio’s post in my News Feed

Source: Facebook, Jared Odulio’s post in my News Feed

When Nikki, also known as The Faceless Trader saw this, she immediately denied the allegation that she is Celeste.

In response to Jared’s post I took a screenshot of Nikki’s reaction and posted it on Jared’s timeline where the above image appeared. Please see Figure 3.

Source: Facebook, Jared Odulio’s Timeline.

Source: Facebook, Jared Odulio’s Timeline.

Jared’s reaction was expected. Being an Expert in Code Breaking, I surmised from his response that he will no longer entertain any contrary opinion so I just kept my thoughts to myself. I really do not believe that Nikki Yu is Celeste because of the following reasons:

1. Their style of writing are very different. While Nikki’s style is factual and straightforward Celeste’s style is satirical and bordering on sarcasm. Celeste’s style is more similar to Zeefreak’s (George Asibal) than anybody else.

2. Nikki, The Faceless Trader, is already well known in the Trading community so there is no need for her to write under another pseudonym.

I would not be surprised if Jared could not believe his eyes when Kristine Pauline Rodriguez, aka Celeste appeared in public totally disproving his post that The Faceless Trader is Celeste. Please see Figure 4.

Source: Facebook Page, Rooting for Celeste

Source: Facebook Page, Rooting for Celeste

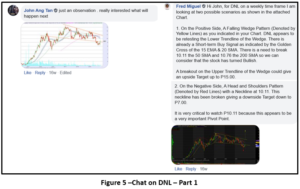

PROJECTED PRICE ACTION FOR DNL

On another occasion, John (John Ang Tan) , asked my opinion on the possible price action of DNL John is an Expert in Technical Analysis and we have known each other since we were both designated as Teacher/Mentors in Stockmarketpilipinas. He fondly calls me Ninja, I am also known as Ninjatrader919 in the Stock Market Forum. Please see Figures 5 and 6

Source: Stockmarketpilipinas, DNL Thread

Source: Stockmarketpilipinas, DNL Thread

As I usually do, I drew two possible Scenarios: a best case scenario of a breakout from a Falling Wedge Pattern with the corresponding target and a worst case scenario of a Head and Shoulders Pattern. My friend is very good in Technical Analysis, so he expressed a contrary opinion on the Head and Shoulders Pattern.

Of course the rest is history. The price of DNL went down and even exceeded the Head and Shoulders Pattern Target that I have drawn. Please see Figure 7

MRC AND MY DON’T GET HYPED POST

I have more inter-actions with other Experts with similar results. In another instance, when I made a post on MRC – DON’T GET HYPED – LEARN TO ANALYZE, there was one trader, Jess Aquino, who argued with me about MRC. He must have been an Expert in Elliott Waves since he buttressed his argument with several concepts from the Elliott Wave Theory.

My post was about Market Phases and it was very clear to see that MRC has already rolled over and gone to the Distribution Stage. I posted a figure from my first book and compared it with the Chart of MRC at that time to prove my point. I usually do not allow myself to be dragged into long arguments so after an exchange or two of views, I ended the discussion by no longer making any reply. Please see Figure 8.

I thought that the other person has already gotten over our discussion and moved on, until somebody from their group sent me this screenshot. Please see Figure 9.

Source: Facebook, MRC Allied Air Force

Source: Facebook, MRC Allied Air Force

It seems to me that the trader has not yet moved on. Long after, our discussion he still mentions my name and my lack of logic whenever he has the occasion to do so. If we do some fact checking, my post was made when MRC closed at P0.64 not P0.94 as he remembers. Please see Figure 10.

Again, the rest is history. MRC continued to roll over and confirmed my statement that it was indeed in the Distribution Stage. Please see Figure 11.

Again the rest is history. From P0.94 the stock has gone down to P0.14 and never realized its “Road to Piso” Hype.

Up to now I have not formed any Facebook Trading Group because I enjoy sharing and learning with other traders. However, when inter-acting with Experts who have already made their opinion, I find it best never to argue with them anymore. Any further discussion is futile since they will no longer change their opinion no matter what kind of evidence you present to the contrary. In such a situation, the best thing to do is let the natural course of events take place and let time be the final arbiter of our views and opinions.

Good luck on all your trades.

=====================================================

In line with our VISION, A RESPONSIBLE TRADER IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. We have successfully launched “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” last September 2, 2019. This book is the second in our Responsible Trader Education Series.

You can download Chapter 1 and see the Table of Contents here: https://drive.google.com/file/d/1NZEABnQMiQ_zenEMs0lPFWweX4WBxBHg/view?usp=sharing

The first book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” provided all the basic knowledge that a trader needs to know in order to trade the Philippine Stock Market effectively and efficiently. The first book is about the basics. This second book is about the specifics.

2. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

3. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

4. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

5. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.