THE RESPONSIBLE TRADER – TRADING LESSONS – GAPS

THE RESPONSIBLE TRADER – TRADING LESSONS – GAPS

The Japanese call gaps as windows. They consider gaps as windows of opportunities. A gap is essentially a price level where no transaction has taken place for a given period. Gaps are formed because of an overwhelming presence of buying and selling interest. In an Uptrend, prices open above the highest price of the previous day, leaving an up-gap on the chart that is not filled during the day.

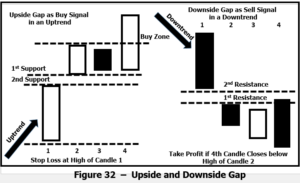

In a Downtrend, prices open below yesterday’s low, leaving a down-gap that is not filled during the day as indicated in Figure 32.

Gaps also act as Support and Resistance areas. A rallying market that gaps to the upside is likely to move in the direction of the trend. Any corrections should find Support in the gap area with the high of the candle before the gap acting as second Support while the low of the candle that gaps up acts as first Support.

Upside Gaps as Buy Signal

The Upside Gap is a bullish continuation pattern. Gaps are sometimes filled before they continue with their prior trend. While we usually say “The gap is being filled,” the Japanese chartist would say, “The window is being closed.” A rallying market that has a window opened is likely to move in the direction of the window. Any corrections should find Support in the window area.

Pattern Setup

1. An Uptrend must be in progress.

2. The first candle is a long white candle. The second candle is a small white candle that gaps up on the open and closes higher. The third candle is a small black candle that opens within the body of the second candle and closes below it.

3. The gap may filled by the third black candle but must not be violated on the downside.

Trading Procedure

1. Buy on the third day. Wait for bullish confirmation by a close on the fourth day that is higher than the highest high of the previous two candles.

2. Set stop loss below the gap.

Downside Gaps as Sell Signal

The Downside Gap is a bearish continuation pattern. As we can see in Figure 32, the rally on the third day did not close the gap, implying that the Bulls are weak.

Pattern Setup

1. Present trend is a Downtrend.

2. The first candle is a long black candle. The second candle is a small black candle that gaps below on the open and closes lower. The third candle is a small white candle that opens within the body of the second candle and closes above it.

3. The gap may be filled by the white candle on the third day but must not be violated on the upside.

Trading Procedure

1. Wait for a bearish confirmation by a close on the fourth day that is lower than the lowest low of the previous two candles.

Good luck on all your trades.

NOTE: No change in numbering of Figure is made so that those who have my second book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market”, can refer to them easily.