The “Road to Piso” Hype

THE “ROAD TO PISO” HYPE

During the several years that I have been trading, I observed a scheme I call “The Road to Piso Hype.” To create awareness about this scheme, I decided to devote one whole Chapter of my book – “Chapter 6 – The Street-Smart Responsible Trader” on this topic.

“ The Road to Piso Hype” is a common ploy used by Unscrupulous Stock Market Operators and Price Manipulators.

The “Road to Piso” Hype takes on many forms – DYM (Double Your Money), TYM (Triple your Money). In the case of CAL, it was a Road to Hundred Pesos and when 50% of the Total Traded Value in the PSE was on CAL, it was touted to become the next Blue Chip and an Index Stock. Sad to say, the company is now embroiled in a lot of controversies and has ended up delisted by PSE.

Whatever form it takes, the objective remains the same –to lure the Victims with the hope of stupendous gains and entice them to make an OVER-COMMITMENT of their Trading Capital, going ALL IN for a GET-RICH QUICK SCHEME.

When I was writing my book, the stock in play was IS – Island Information and Technology, Inc. so I was able to study it in detail.

The Hype as a Prelude to the Pump and Dump

In stock trading, we define HYPE as an exaggerated statement or price projection that is not based in truth or in fact.

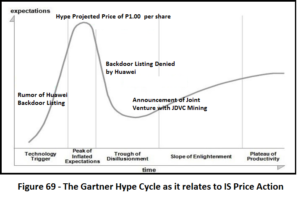

My research has led me to the Gartner Hype Cycle used mostly in technology firms. The same model, to a certain extent, also apply to stocks being hyped in the Philippine stock market.

Let us take a look at the model and relate it to one of the stocks that was recently heavily hyped, Island Information & Technology, Inc. (IS) in Figure 69. All the Figures in this Blog post are taken from my book and I have not changed the numbering so that readers who have the book will be able to refer to the things I am saying.

1. Innovation trigger. Rumor of the company being considered for backdoor listing by Huawei Technologies, Philippines, a leading global ICT solutions provider, started spreading around. Before this, hypers have already accumulated a substantial amount of the stock at Lower prices for unloading later on.

2. Peak of inflated expectations. Charts and analyses sprouted like mushrooms in social media and Facebook groups. Price projection for the stock to reach P1.00 per share started appearing. The stock became a favorite topic in Facebook, stock trading forums and chatrooms.

3. Trough of disillusionment. Huawei Technologies, Philippines, denied any plan for backdoor listing proving that rumors are just based on speculations. Those who bought at the Highs are now stuck and do not have a clue what to do next – to hold or to cut losses.

4. Slope of enlightenment. To give hope to those who are stuck and prepare for further unloading later on, news of a joint venture with JDVC for mining started appearing. The hope was crushed when the joint venture did not push thru.

5. Plateau of productivity. For hyped stocks in the Philippine stock market, this point is never reached. The stock hibernates until some groups start with Stage 1 again.

Let’s see how this translates in Chart 39 of IS (Island Information & Technology, Inc.).

Sadly, the highest price it reached was P0.81 and as of this writing is now languishing at the P0.12 level – a far cry from the P1.00 Target Price.

Many people, especially those who are not affected, are prone to dismiss this as something ordinary happening in the stock market without realizing the adverse consequences. The traders who got burned get traumatic experiences and swear never to trade the market again. The frustration spills over to relatives and friends and discourages them from even considering the stock market as a vehicle for investment. The ultimate result – destruction of the Philippine capital markets because of the disillusionment and distrust created.

With the Index dropping below the 8000 level, I am afraid it could usher in the “Basura” season again.

Based on my observation, the HYPE is usually a prelude to a Pump and Dump Scheme. Whether we like it or not, Hypes and Hypers are here to stay. We just need to be vigilant and aware about the existence of this scheme to avoid becoming victims in the future.

As I have stated in my previous posts. DON’T GET HYPED. LEARN TO ANALYZE. If I may further add. LEARN TO DISCERN. IF IT SOUNDS TOO GOOD TO BE TRUE, you SHOULD KNOW WHAT TO DO.

Good luck on all your trades.

Very informative especially to newbie. Thank you for sharing this to social media.

Hi Mike,

You’re welcome. I am glad you like it. The blog post is really intended to inform newbies about possible dangers they could encounter when trading in order to

help them avoid becoming a victim.

Best regards,

Fred/@theresponsibletrader