THE RESPONSIBLE TRADER – TRADING LESSONS – TRADING GAPS – PART 2

THE RESPONSIBLE TRADER – TRADING LESSONS – TRADING GAPS – PART 2

In our previous lesson, we learned about the proper procedures for trading gaps.

However, not all gaps are tradable. Please allow me to quote what I have written in my first book – “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” about this particular subject matter.

“Gaps – The 4 Types of Price Gaps

A common expression you will usually hear from traders is “babalikan yung gap” (the gap will be filled). Actually, I have heard this so many times and some people even seem to say it with conviction and with certainty as if they have a magic formula for anticipating price movements. So let us take a closer look at gaps and find out if this is another one of those “old-wives” tales in the stock market.

Gaps are areas where no trading transaction has occurred. A gap is created when the close of the previous day and the open of the following day have different price levels.

Not all gaps are created equal. Actually, there are Four Type of Gaps -the Breakaway, the Runaway or Measuring, the Exhaustion and the Common Gaps.

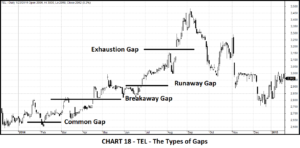

All of these are shown in Chart 18 – TEL (Philippine Long Distance Telephone Company) – The Types of Gaps. The Gaps shown here are for a stock on an Uptrend.

The Breakaway Gap

The Breakaway Gap usually signals the end of a consolidation or completion of an important price pattern. Major breakouts from Neutral Chart Patterns like the Rectangle and Symmetrical Triangle are usually starting points for this type of gap.

This gap can also be seen during major trendline breaks signaling the reversal of trend. An example of this can be seen when TEL broke out from consolidation on April 21, 2014 by gapping up and breaking out of a major Resistance.

Breakaway gaps usually occur on heavy volume. This is the type of gap that most often is not filled. As a rule, the heavier the volume after such a gap appears, the less likely it is to be filled.

The Runaway or Measuring Gap

The Runaway or Measuring Gap usually occurs after the move has been under-way or around the middle of the move. This can be seen in the same chart where TEL gapped up on June 26, 2014 after a cross doji.

When this gap happens in an Uptrend it is a sign of strength. Conversely, it is a sign of weakness when it happens during a Downtrend. Just like the Breakaway Gap this is also often not filled. A close below this gap in an Uptrend is an evidence of weakness of the trend.

The Exhaustion Gap.

The Exhaustion Gap, as the term implies happens near the end of a market move. It is like a runner who has used all of his energy so he needs to rest. This gap is always filled. When prices close under this gap, it is a clear evidence that the exhaustion gap has made its appearance. This is a classic example where price falling below a gap in an uptrend has very bearish implications. This is shown in the same chart where TEL created an Exhaustion Gap on August 14, 2014. The confirmation that the Exhaustion Gap has made its appearance happened when the Exhaustion Gap was filled on September 29, 2014 by a Black Marubozu.

Common gap

A Common Gap is a gap that usually happens anytime. Unlike the other types, they can happen frequently without any major implications about further price movements. Common gaps often occur when price is ranging. This gap is not big in size and gets filled relatively quickly. This can be seen from the same chart on February 7, 2014 when price gapped up a little bit and was filled immediately.

From this Section we learned that not all gaps are filled. Next time you hear another trader mention it, just smile because you now know better.”

From this discussion, which of the gaps are tradeable? If you answered Breakaway and Runaway you are correct. These gaps are the only ones that are tradeable and offer low-risk high probability trades. Of course in the case of PLDT, the Exhaustion Gap seems to be still tradable and looks most profitable but this is not always the case.

Just be sure to always set a stop loss whenever the trade set-up does not materialize and you should do well on your trades.

Good luck on all your trades.

NOTE: No change in numbering of Figure is made so that those who have my book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market”, can refer to them easily.

=====================================================

In line with our VISION, A RESPONSIBLE TRADER IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. We have successfully launched “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” last September 2, 2019. This book is the second in our Responsible Trader Education Series.

You can download Chapter 1 and see the Table of Contents here: https://drive.google.com/file/d/1NZEABnQMiQ_zenEMs0lPFWweX4WBxBHg/view?usp=sharing

The first book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” provided all the basic knowledge that a trader needs to know in order to trade the Philippine Stock Market effectively and efficiently. The first book is about the basics. This second book is about the specifics.

2. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

3. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

4. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

5. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.