Top Ten Smart Money Moves Apr. 14, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 14, 2016 Data)

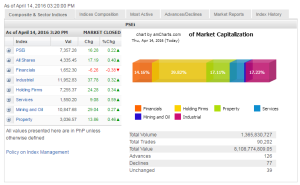

Total Traded Value – PhP 8.109 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 126 Advances vs. 77 Declines = 1.64:1 Neutral

Total Foreign Buying – PhP 4.102 Billion

Total Foreign Selling – (Php 4.592) Billion

Net Foreign Buying (Selling) – (Php 0.490) Billion – 2nd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

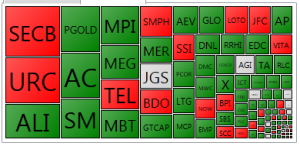

PSE Heat Map

Screenshot courtesy of: PSEGET Software

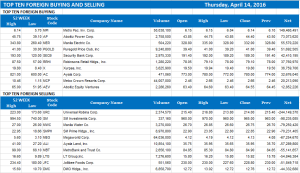

Top Ten Foreign Buying and Selling

and Selling

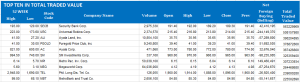

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 14, 2016 08:21:00 PM

PSE index climbs as corporates boost Wall Street

STOCKS trekked higher on Thursday after investors cheered positive corporate earnings in the US and as reports by local firms mostly met market expectations.

The 30-company Philippine Stock Exchange index (PSEi) climbed by 16.28 points or 0.22% to close at 7,357.28.

The broader all-shares index also rose 17.19 points or 0.39% to settle at 4,335.45.

“It’s actually earnings related, due to favorable figures in the US last night. As a result, regional markets followed,” Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a phone interview.

On Wall Street, the Dow Jones industrial average and the tech-heavy Nasdaq index posted gains. All Asian markets, except for the Jakarta Composite index, were also in the green.

“Domestically, we are winding down on full-year results. So far, at least 60% of our covered stocks are in line with estimates,” Mr. Azurin said.

Five out of six domestic subindices ended in the green, with services jumping by 9.08 points or 0.58% to 1,550.20. The property sector advanced by 13.86 points or 0.45% to 3,036.57; holding firms gained 24.28 points or 0.33% to 7,255.37; industrials tacked on 37.78 points or 0.31% to 11,952.83; and mining and oil edged up by 29.04 points or 0.26% to 10,847.68.

Only the financial sector fell into negative territory after sliding by 6.26 points or 0.37% to 1,652.30.

Yesterday’s major gainers were Ayala Land, Inc., its parent Ayala Corp., and Aboitiz Power Corp., accounting for 10 points of the index’s rise, according to Mr. Azurin.

Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., said in a report: “[E]ven as the bulls eased back late in the session, the PSEi held above the 7,350 line, kept a wide positive breadth and pulled in P8.11 billion at the closing bell.”

“This is shaping up as the best week of the market since posting a 2.9% gain in the period ending March 18th. With Friday’s trade in the balance, the PSEi posts a 1.5% advance off the flat close the previous week,” Mr. Calaycay added.

Thursday’s value turnover increased to P8.11 billion after 1.37 billion shares changed hands, from the P7.7 billion seen in the previous sessions.

Net foreign selling persisted for a third straight session but shrank to P490.51 million from P660.86 million.

Advancers overwhelmed decliners, 126 to 77, while 39 names did not move.

“The big story [today] however will be China which will release its GDP (gross domestic product) for 1Q (first quarter) about half an hour after local trades begin. Also up for the world’s largest economy are data on Industrial production, fixed asset investment and a press conference by the National Bureau of Statistics,” Mr. Calaycay said.

Unicapital’s Mr. Azurin noted that the PSEi is poised to retest the next major resistance at 7,400, while support lies at 7,150. — Daphne J. Magturo

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-climbs-as-corporates-boost-wall-street&id=125985

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

hi sir i would like to to have a copy of your book. kindly text me na lang po coz im not regularly open my email. where to dposit the payment. my complete address when i receive your reply. salamat po

Hi Leny,

For those who cannot access our website we are now allowing DIRECT ORDERS. Please follow the following procedures:

PROCEDURES FOR MAKING DIRECT ORDERS

1. Send email to ninjatrader919@gmail.com put Subject: DIRECT ORDER – YOUR BOOK.

2. Indicate

a. Your name and where you want the book delivered to. This will be my guide in responding to you and providing the corresponding courier charges. Also indicate your telephone number because this is required by the courier so they can communicate with you in case of concerns encountered in shipment.

b. Quantity ordered. If more than 1, Indicate name/s of person you want me to dedicate the book to.

c. Wait for my email response for the courier charges and complete payment instructions.

d. After making your payment, scan copy of the Deposit Slip and send to me: ninjatrader919@gmail.com

e. Wait for my acknowledgment of your payment and my confirmation that you are included in the scheduled shipment.

Those who have previously received payment instructions from me need not send me another email. Just follow the payment instructions and email scanned copy of the Deposit Slip to me.

Best regards,

Fred/@theresponsibletrader