Top Ten Smart Money Moves – Apr. 29, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 29, 2016 Data)

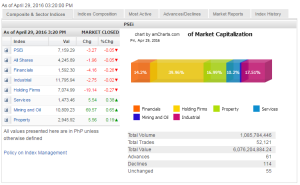

Total Traded Value – PhP 6.076 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 110 Advances vs. 71 Declines vs. = 1.87:1 Neutral

Total Foreign Buying – PhP 4.073 Billion

Total Foreign Selling – (Php 3.824) Billion

Net Foreign Buying (Selling) – Php 0.249 Billion – 1st day of Net Foreign Buying after 1 day of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

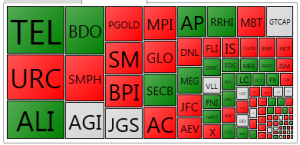

PSE Heat Map

Screenshot courtesy of: PSEGET Software

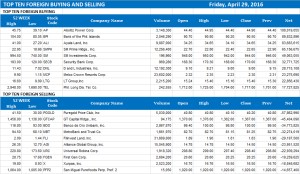

Top Ten Foreign Buying and Selling

and Selling

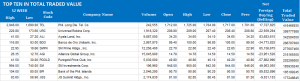

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on May 01, 2016 07:25:00 PM

By Daphne J. Magturo, Reporter

Q1 corporate earnings to dictate trading ahead

FIRST-QUARTER corporate earnings will dictate the market’s direction this week, although shares will likely trade with a downward bias due to uncertainties caused by next Monday’s elections, analysts said.

A trader is shown at work in this Sept. 28, 2012 file photo taken at the trading floor in Makati City. — BW FILE PHOTO RELATED STORIES

Trading ‘quiet’ on poll campaign noiseSigns of recovery surface amid general weaknessSectoral indices retreat ahead of Fed, BoJ remarksWeakness persists as caution rules tradingInvestors await US, Japan central bank signals

Week on week, the benchmark Philippine Stock Exchange index (PSEi) wiped out 96.1 points or 1.33% to close at 7,159.29 on Friday from 7,255.39 on April 22, while the broader all-shares index similarly fell by 83.52 points or 1.93% to settle at 4,245.89 from 4,329.41 in the same comparable periods.

“This week, we expect the rest of the local listed companies to report their first-quarter results. Market players are expected to take cue from that as well as significant economic data releases such as the US nonfarm payroll and domestic inflation,” BPI Asset Management said in its weekly review.

The market anticipates earnings reports from blue chips like Metropolitan Bank & Trust Co.; Ayala Land, Inc.; PLDT, Inc.; Metro Pacific Investments Corp.; Globe Telecom, Inc.; and Aboitiz Equity Ventures, Inc. “Their announcements could steer the market’s direction… or it may not. After all, next week is the final week before the presidential elections on May 9 and skittish investors could prefer to take some money off the table,” Ralph Christian G. Bodollo, analyst at RCBC Securities, said in a report.

Corporate earnings are largely expected to be “positive and should ultimately guide the market in the near term,” according to AB Capital Securities, Inc. “Aside from the uncertainty of the elections, there is a lack of lead positive indicators in the international and domestic markets.”

On a technical basis, the main index is expected to trade between the 7,050 and 7,220 levels, according to BPI’s investment arm.

AB Capital noted that the PSEi is now in a “downtrend,” with the index likely to fall to the 6,900-7,000 range “due to uncertainties pre-election.”

“Otherwise, we see a relief rally due to happen next week, which could take the index back at the 7,200 level. RSI (relative strength index) at 45.28 suggests that the market is trending sideways, signaling the lack of market momentum and direction,” it said.

Last week saw overseas investors snapping up more local shares than they sold, resulting in net foreign buying of P636.9 million.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=q1-corporate-earnings-to-dictate-trading-ahead&id=126798

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion