Top Ten Smart Money Moves – Apr. 4, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 4, 2016 Data)

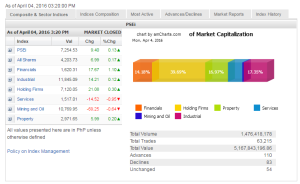

Total Traded Value – PhP 5.168 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 110 Advances vs. 83 Declines = 1.33:1 Neutral

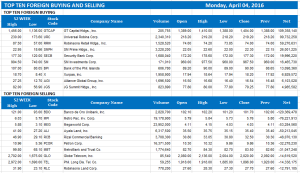

Total Foreign Buying – PhP 2.479 Billion

Total Foreign Selling – (Php 2.609) Billion

Net Foreign Buying (Selling) – (Php 0.130 Billion) – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

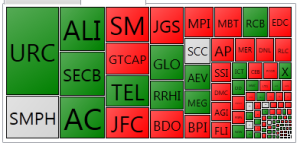

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

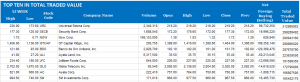

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 04, 2016 09:21:00 PM

By Daphne J. Magturo, Reporter

Stocks rise as US data point to firming economy

LOCAL SHARES eked out modest gains yesterday after early optimism sparked by solid US jobs data was offset by a slump in telco stocks, analysts said.

The Philippine Stock Exchange index (PSEi) inched up by 9.40 points or 0.13% to close the week’s first trading day at 7,254.53.

The broader all-shares index also added 6.99 points or 0.16% to settle at 4,203.73.

“The rise was inspired by improved manufacturing and jobs numbers which, while boosting the [Federal Reserve]’s bias towards tightening, does not alter the prevailing consensus that the April meeting won’t see it happen — yet,” Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., said in a client note yesterday.

“Janet Yellen’s most recent pronouncement that interest rates will stay low for a longer-time — a fresh version of ‘gradual adjustments’ — and paring expected hikes for this year to just two from four have moved bets to the next meeting later in the year,” he added.

Reuters reported that nonfarm payrolls in the US went up by 215,000 in March, exceeding expectations. Average hourly earnings improved by seven cents, recovering from a slip in February.

Anton G. Alfonso, analyst at RCBC Securities, Inc., said in a telephone interview after trading hours: “The market had gains earlier because of the jobs data, but these were capped by PLDT (Philippine Long Distance Telephone Co.) and Globe [Telecom, Inc.]”

“There were some profit taking after the recent surge when Telstra [Corp. Ltd.] announced that it would no longer join San Miguel Corp. in its wireless joint venture,” he added.

Four out of six domestic subindices ended in the green, with financials gaining 17.67 points or 1.10% to 1,620.31. Holding firms advanced by 21.08 points or 0.29% to 7,120.05; property went up by 5.99 points or 0.20% to 2,971.65; and industrials edged up by 14.21 points or 0.12% to 11,845.09.

In contrast, services lost 14.52 points or 0.94% to 1,517.01 after PLDT shares fell 1.25% and Globe stocks plunged 3.44%. The mining and oil counter dropped 69.25 points or 0.63% to 10,769.95.

Yesterday’s top gainers were Emperador, Inc., JG Summit Holdings, Inc. and Energy Development Corp., while major losers were Petron Corp., Globe and DMCI Holdings, Inc., according to RCBC’s Mr. Alfonso.

Value turnover remained thin at P5.17 billion with 1.48 billion shares changing hands, from the P5.78 billion seen on Friday.

Net foreign selling amounted to P130.59 million, reversing the P80.18-million net inflow in the preceding session. Gainers overpowered losers, 110 to 83, while 54 issues did not move.

“We will continue to follow the movement of the US and monitor select stocks that will release earnings until the deadline on April 15,” said RCBC’s Mr. Alfonso.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-rise-as-us-data-point-to-firming-economy&id=125441

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

How to order the book& how much the book?

Hi Vicente,

The book’s price is P999.00. Just click the book icon you see on the Featured Ads column in our website, fill up the Order Form and wait for our payment instructions.

Best regards,

Fred