Top Ten Smart Money Moves – April 20, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on April 20, 2018 Data)

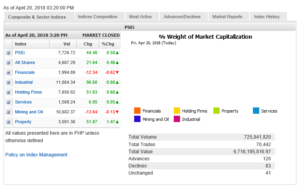

Total Traded Value – PhP 6.716 Billion – Low

Advances Declines – (Ideal is 2:1) 120 Advances vs. 83 Declines = 1.45:1 Neutral

Total Foreign Buying PhP 3.998 Billion

Total Foreign Selling – (PhP 4.379) Billion

Net Foreign Buying (Selling) (PhP 0.381) Billion – 2nd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

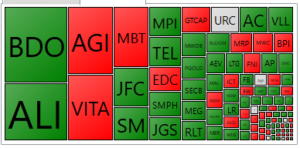

PSE HEAT MAP

Screenshot courtesy of PSEGET

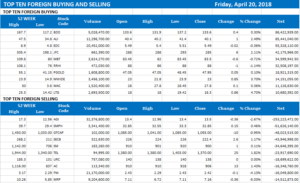

Top Ten Foreign Buying and Selling

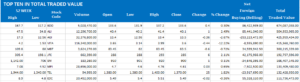

Top Ten in Total Traded Value

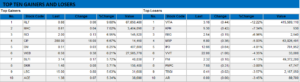

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Market to remain volatile amid overseas tensions

April 23, 2018 | 12:01 am

VOLATILITY may prevail in the week ahead, following the Philippine Stock Exchange index’s (PSEi) sharp decline last week due to a mix of geopolitical concerns and fears of an overheating economy.

The bellwether PSEi ended 0.57% or 44.48 points higher to 7,726.72 last Friday, managing to eke out gains after its steep fall on Thursday. The main index had dropped by more than 3% in that session, but was able to pare down losses before the market’s close.

On a weekly basis, the index lost 2.19% or 173.26 points. Volume, however, started to pick up, with value turnover rising 43% to P7.52 billion on average. Foreign outflows swelled to P580 million versus the P350 million recorded the week before.

“Negative undertone prevailed during the week and pulled gauges to weaker terrain. The threat for a potential border conflict in Syria following the firing of cruise missiles against Bashar al-Assasd’s regime prompted sellers to panic,” online brokerage 2TradeAsia.com said in a weekly report.

The online brokerage said these dips in the index can provide buying windows for investors.

“Regardless, the global economy moves in cycles and there are pain points to consider in any adjustment process. The reality is that there are people who will prevail in these trying times, versus those who are quick to throw in the towel. This phenomenon explains volatility that presents buying windows,” the company said.

Eagle Equities, Inc. Research Head Christopher John Mangun gave two possible outcomes for the index this week, with the first scenario placing the market on a consolidation mode within the 7,600 to 7,750 range. On the other hand, the index could also trek lower by 200 points until it reaches a support level at 7,500.

“If this happens, we will see volume or value turnover pick up,” Mr. Mangun said in a weekly market report.

The Eagle Equities analyst, however, flagged concerns of rising oil prices, which have been hitting record high prices since 2014.

“Higher oil prices mean higher inflation, and this may have a negative effect on the market. Small and mid-cap companies still pose better opportunities for investors,” Mr. Mangun said.

2TradeAsia.com also pointed to first-quarter earnings results to guide investors in making decisions on buying stocks.

“Moving further, preliminary indications of first-quarter 2018 performance will serve as proxy guidance, that may convince skeptics whether growth targets will be in line this year,” the online brokerage said.

2TradeAsia.com placed the index’ immediate support between 7,500 to 7,600, while resistance will be from 7,800 to 7,900.

Meanwhile, Wall Street’s three major indexes declined on Friday as investors worried about a jump in US bond yields, with technology stocks leading the decline on nerves about upcoming earnings reports and iPhone demand. — Arra B. Francia with Reuters

Source: http://bworldonline.com/market-to-remain-volatile-amid-overseas-tensions/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.