Top Ten Smart Money Moves – August 11, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 11, 2016 Data)

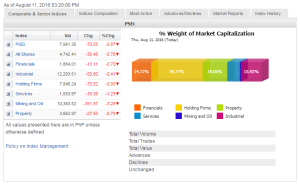

Total Traded Value – PhP 17.559 Billion – High

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 137 Declines vs. 61 Advances = 2.25:1 Bearish

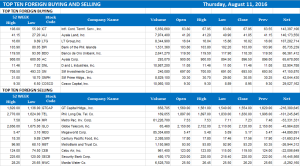

Total Foreign Buying – PhP 11.592 Billion

Total Foreign Selling – (PhP 4.572) Billion

Net Foreign Buying (Selling) PhP 7.020 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

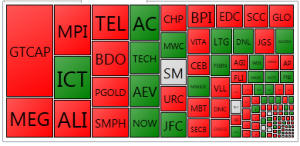

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

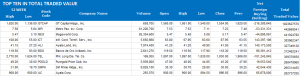

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks slip as earnings season draws to a close

Posted on August 12, 2016

LOCAL SHARES eased a bit on Thursday as the financial reporting season winds down after a quarter that saw companies meeting expectations and many others beating forecast earnings.

Yesterday, the Philippine Stock Exchange index (PSEi) gave up 70.05 points or 0.87% to settle at 7,981.35. The broader all-shares index also dropped 36.48 points or 0.76% to 4,742.41.

Nisha S. Alicer, chief equity analyst at DA Market Securities, Inc., said the market “has rallied substantially, confirming strong first-half earnings results and forward estimates.”

She said conglomerates, property, consumer and energy picks have provided dividends and long-term growth.

“While we recognize some short-term profit taking in the market, demand has kept the PSEi above current support of 7,850,” Ms. Alicer said.

All sectors declined with mining and oil giving up the most at 351.97 points or 3.27% to 10,383.52 amid the uncertainty facing many mining companies after a number of ventures have been ordered closed by Environment Secretary Regina Paz L. Lopez, a known anti-mining advocate.

Ms. Lopez also ordered a review of existing environmental compliance certificates of mining projects, including the coal pit mines of listed Semirara Mining and Power Corp.

The second biggest loser was services, which slipped 19.38 points or 1.23% to 1,553.97, followed by property, which lost 27.56 points or 0.74% to 3,662.97.

Miko A. Sayo, trader at Angping & Associates Securities, Inc., said the market had already discounted the earnings data when the index hit 8,000.

He added that most reports were just in line with expectations.

DA Market’s Ms. Alicer recommended “buying on pullbacks for companies we think will provide strong growth rate for 2017 as we roll estimates at the midpoint of the year.”

“Money management is also key,” she said.

Decliners outpaced advancers at 137 to 61, while 39 stocks closed unchanged.

The total value of traded stocks more than doubled to P17.56 billion yesterday from P8.21 billion Wednesday.

Foreign investors bought more shares than they sold, resulting in a net buying of P7.02 billion out of P16 billion in total trades. This was also a reversal of Wednesday’s net foreign sales worth P121.46 million.

Yesterday, HSBC Global Research issued its assessment of regional earnings and described those of Philippine companies as Asia’s “star performer” during the quarter.

It said local firms had the “most beats” as aggregate earnings for the quarter grew by 15.9% year on year, which it said was “significantly stronger” than the consensus forecast of a 10% decline.

“The Philippines has seen most beats and Korea has surprised on the upside as well; Singapore has seen most misses,” it said comparing the country with its peers in Asia. — V.V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-slip-as-earnings-season-draws-to-a-close&id=131780

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion