Top Ten Smart Money Moves – August 12, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 12, 2016 Data)

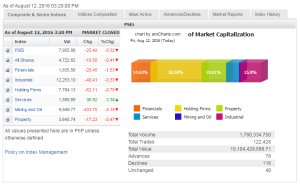

Total Traded Value – PhP 10.104 Billion – High

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 116 Declines vs. 78 Advances = 1.49:1 Neutral

Total Foreign Buying – PhP 5.103 Billion

Total Foreign Selling – (PhP 5.176) Billion

Net Foreign Buying (Selling) (PhP 0.073) Billion – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

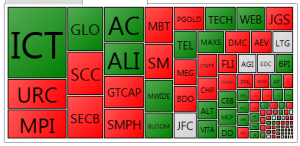

PSE HEAT MAP

Screenshot courtesy of PSEGET

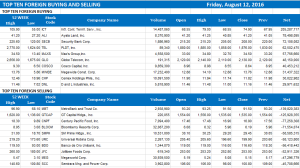

Top Ten Foreign Buying and Selling

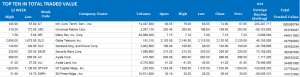

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks to move sideways as market seeks leads

Posted on August 15, 2016

LOCAL SHARES are expected to continue moving sideways this week as investors eye developments on policy statements by the government that have been weighing down gaming and mining stocks in the past few days, analysts said.

“The investing public is watching the development,” said Harry G. Liu, president of Summit Securities, Inc., referring to actions and pronouncements state agencies, including the Environment department as well as the gaming regulator.

“Technically speaking, we’re going on a medium-term sideways movement between the support level of 7,850 and the resistance at 8,150,” he said. “As long as we stay within this window, it’s fine because we’re just waiting for further positive news. Then we can break the 8,150.”

He said that once the “mining and gaming situation” is clear, the positive effect of the strong financial reports that came out in the last two weeks will creep in, then the market can sustain its rise and push higher.

Last week, Department of Environment and Natural Resources (DENR) Secretary Regina Paz “Gina” L. Lopez said in a briefing that her office had issued a “show cause” order on Semirara Mining Power Corp.’s (SMPC) open-pit mine on Semirara Island in Antique province. The mine supplies coal to the company’s two-unit 600-megawatt power plant in Calaca, Batangas.

Leo L. Jasareno, DENR senior undersecretary who heads the team auditing the country’s metal mines, said last week that the open pit was already below sea level and had left a “big hole” in the area that raises the question about its rehabilitation.

On Thursday, SMPC told the stock exchange that it had yet to receive a copy of any order from the DENR, and that it would respond once it had “complete official information.”

On Friday, shares in the country’s biggest coal producer fell by 7.52% to P100.80 from P109 previously.

Days earlier, PhilWeb Corp. saw its shares plummeting after President Rodrigo R. Duterte said that he was out to destroy oligarchs, and singled out the company’s Chairman and Chief Executive Officer Roberto V. Ongpin as an “oligarch.”

The Philippine Amusement and Gaming Corp. later notified PhilWeb that its license would not be renewed and that it must cease operations.

“Globally, I don’t see any negative disruption to the global market… [barring] unforeseen sudden situation,” Mr. Liu said. “But based on what we have now and what is going on, it will set the market sideways waiting for better news to come in.”

The Philippine Stock Exchange index (PSEi) finished the week at 7,955.86, lower by 0.18% compared with its close a week earlier. It was also lower by 0.92% compared with the earlier month.

By a sectoral week-on-week comparison, only the industrial index finished higher at 0.11% to 12,253.10. Mining and oil stocks recorded the biggest decline at 8.76% to 9,949.77. — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-to-move-sideways-as-market-seeks-leads&id=131886

==================================================

My book – “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” has received very positive response both here and abroad and it has earned the moniker “The Bible of Philippine Trading.”

As author of the book, I have been nominated under the Category of “Influential Author of the Year Award” conducted by the Angat Pilipinas Coalition for Financial Literacy. If this website has helped you in any way, kindly take the time to vote by clicking on this link:

http://angatph.com/angat-awards-and-nominations/polling-booth-angat-pilipinas-awards-2016/

and then log in with your Facebook Account so your vote will be counted. Online voting ends August 18, 2016. Thank you for your support.

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion