Top Ten Smart Money Moves – August 16, 2019

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

================================

As promised in my last post, Back from the Hack, we are resuming all our activities both in our website and Facebook starting August 1, 2019.

This section of our website has been running for the past five years. Perhaps you are asking, why Top Ten Smart Money Moves? This is what I have written in my new book: “Swing Trading with TRT – A Definitive Guide for Swing Trading the Philippine Stock Market.”

“SMART MONEY

The PSE achieved a milestone by the end of the year 2018 when they reported that the number of stock market accounts broke past the one million mark as a result of the substantial increase in online accounts.

Retail investors owned most of the stock market accounts, representing 97.5% of the total accounts while the remaining 2.5% is held by the institutional investors also considered as smart money.

While we, the retail traders, are big in number, we are small in terms of influence in the stock market because more than 50% of the Total Traded Value Daily is accounted for the institutional investors whose transactions are focused mostly on a handful of their selected stocks.

In our Website, we have a regular feature “Top Ten Smart Money Moves” where we monitor the Top Ten stocks being bought and sold by the smart money.

========================================================

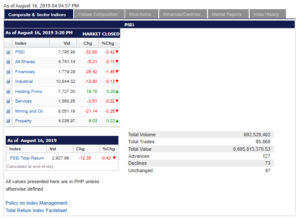

Trading Notes for Today – (Based on August 16, 2019 Data)

Total Traded Value – PhP 8.696 Billion – Medium

Advances Declines – (Ideal is 2:1) 127 Advances vs. 73 Declines = 1.74:1 Neutral

Total Foreign Buying PhP 4.136 Billion

Total Foreign Selling – (PhP 3.838) Billion

Net Foreign Buying (Selling) – PhP 0.298 Billion – first day of Net Foreign Buying after 8 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

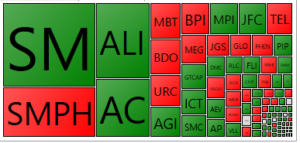

PSE HEAT MAP

Screenshot courtesy of PSEGET

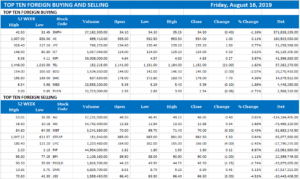

Top Ten Foreign Buying and Selling

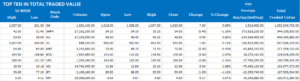

Top Ten in Total Traded Value

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Geopolitical tensions seen affecting PHL shares

August 19, 2019 | 12:01 am

By Arra B. Francia

Senior Reporter

THE MAIN INDEX may decline in the week should foreign investors continue to dump their shares in the local bourse due to the negative sentiment from geopolitical tensions abroad.

The benchmark Philippine Stock Exchange index (PSEi) slipped 0.42% or 32.88 points to close at 7,795.98 on Friday. It dropped 0.74% on a weekly basis, marking its fourth straight week in the red.

Net foreign selling stood at P4.53 billion on the back of a P35.64-billion turnover. The banking sector suffered most as it lost 3.91%, with both Security Bank Corp. and the Bank of the Philippine Islands down by more than 5%.

“If we see another sell-off from foreign investors, then this market may see another week of losses. We also may see the market calm down as investors wait out this storm,” AAA Southeast Equities, Inc. Research Head Christopher John Mangun said in a market report.

“The market is looking weaker and weaker by the day, and despite solid economic fundamentals and corporate earnings growth, it could not shake off the effect of these external headwinds.”

The PSEi followed most global stock markets which also ended lower last week as investors feared the possibility of a recession in the United States due to the US Treasury yield curve’s inversion.

An inverted yield curve happens when short-term bonds have higher interest rates compared to long-term bonds, indicating that investors see lower risks for long-term investments. Historically, this scenario has preceded every US recession since 1955.

On top of fears of a US recession, the trade war between the US and China has yet to see any new developments. In the meantime, US President Donald J. Trump has suggested to meet with Chinese President Xi Jinping to help resolve the Hong Kong protests.

Meanwhile, Papa Securities Corp. Sales Associate Gabriel Jose F. Perez said the index will take its cues from Wall Street’s performance.

“The index will have to take its cues from US markets [this] week on a lack of clear and major catalysts for the PSEi,” Mr. Perez said in an e-mail.

On Friday, the Dow Jones Industrial Average jumped 1.20% or 306.62 points to 25,886.01, recovering after an 800.49-point drop midweek — its worst performance so far in 2019. The S&P 500 index also climbed 1.44% or 41.08 points to 2,888.68, while the Nasdaq Composite index went up 1.67% or 129.38 points to 7,895.99.

Investors are also looking at a shortened trading week as financial markets will be closed on Wednesday, Aug. 21, for Ninoy Aquino Day.

AAA Equities’ Mr. Mangun pegged the market’s support at 7,630 to 7,750, with resistance from 7,920 to 8,000.

Source: https://www.bworldonline.com/geopolitical-tensions-seen-affecting-phl-shares/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.