Top Ten Smart Money Moves – August 24, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 24, 2016 Data)

Total Traded Value – PhP 9.967 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 136 Declines vs. 55 Advances = 2.47:1 Bearish

Total Foreign Buying – PhP 4.268 Billion

Total Foreign Selling – (PhP 5.756) Billion

Net Foreign Buying (Selling) (PhP 1.488) Billion – 2nd day of day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

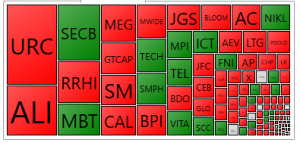

PSE HEAT MAP

Screenshot courtesy of PSEGET

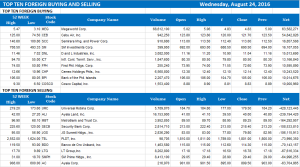

Top Ten Foreign Buying and Selling

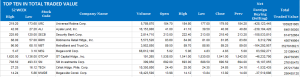

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Foreign selling drags PSEi below 7,900 territory

Posted on August 25, 2016

By Victor V. Saulon, Sub-Editor

THE main index failed to sustain its hold above the 7,900 — a level it stuck to for over a week — after foreign investors dumped over P1 billion of shares amid jitters over the direction of US interest rates.

Joseph Y. Roxas, president of Eagle Equities, Inc., said the market was having difficulty pushing for a rally.

“There might be a pullback first,” he said.

The Philippine Stock Exchange index (PSEi) declined by 69.05 points or 0.87% to 7,866.13, while the broader all-shares index slipped by 36.31 points or 0.77% to 4,662.63.

Miko A. Sayo, a trader at Angping & Associates Securities, Inc., blamed the decline to foreign selling. He expects the next support at 7,750. Early in the week, he was “cautiously bullish” as the market appeared to be holding on above 7,900. The PSEi stayed above the 7,900-mark for nine days after rising past 8,000 for two days.

Foreign investors sold P5.76 billion worth of shares and bought far less at P4.27 billion, resulting in a net selling of P1.49 billion, or more than three times Tuesday’s P464.51 million.

The total value of trading increased to P9.97 billion, up nearly 46% from P6.85 billion previously.

Five stocks lost for every two that rallied or 136-55, while 48 issues finished unchanged.

The mining and oil index was the only sector that finished in the green as it gained 38.92 points or 0.37% to 10,651.66. Global Ferronickel Holdings, Inc. was among the top gainers.

Industrial stocks recorded the biggest drop at 165.43 points or 1.38% to 11,831.36.

PhilWeb Corp. shares surged by 17.39% to close at P5.40 each. The listed gaming company wrote a letter to the Philippine Amusement and Gaming Corp. (Pagcor), presenting its business plan that is based on a proprietary software developed by the company that allows a lotto bettor to text his chosen number to PhilWeb or Pagcor servers via Smart mobile phones. PhilWeb placed the potential revenue from the proposal, called Pagcor text bonanza, at P50 billion to P100 billion a year.

Universal Robina Corp., Ayala Land, Inc., Security Bank Corp., Robinsons Retail Holdings, Inc. and Megaworld Corp. were the most active stocks.

Losing the most on Wednesday’s session were Leisure & Resorts World Corp., Bloomberry Resorts Corp., Pryce Corp., SOCResources, Inc. and Makati Finance Corp.

Before yesterday’s session, 2TradeAsia.com was expecting some gains, which it said might be offset “by the growing concerns ahead of the Jackson Hole symposium on Friday as investors will be taking their cue from any hints on what will be the decision on the Fed’s next meeting on September. Immediate support 7,890, resistance 8,000.”

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=foreign-selling-drags-psei-below-7900-territory&id=132427

==================================================

The Angat Pilipinas Coalition for Financial Literacy Polls was extended until August 25, 2016. Today is the Last Day. Vote Now to Avoid the RUSH.

I have been nominated for the “Influential Author of the Year” Award. Choose Carefully. Vote Wisely. Vote for the one with the Complete Financial Literacy Package.

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

Vote now to avoid the rush. Please click this link:

http://angatph.com/angat-awards-and-nominations/polling-booth-angat-pilipinas-awards-2016/

No need to register thru your email account. Just log in with your Facebook account so your vote will be counted.

We would appreciate it very much if you can tell your friends to do the same.

Thank you very much for your support.

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion